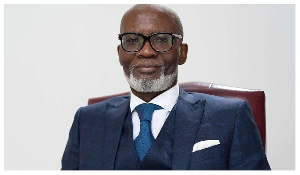

Access to funding is a major challenge facing start-up businesses. Many business owners believe that it is impossible to start a business without funding. Nonetheless, the Head of Enterprise Banking at Stanbic Bank, Pearl Nkrumah, insists starting a business is not always about funding.

Pearl Nkrumah said this when she spoke on “Access to Finance for Women Entrepreneurs” at the 2018 Ghana Women’s Entrepreneurial Summit (GWES) in Accra.

“It is not enough for a start-up to have just an idea of a great business and think funding will solve every other problem – it is not always about funding. It takes discipline, passion, positive energy, confidence, and above all, the practice and implementation of good corporate governance structures to start a business. Funding comes in after one has shown a clear proof of investment. Access to financing is easier than it was before but start-ups must have good corporate structures to be able to attract funding from banks to avoid the collapse of their business,” Ms. Nkrumah said.

Pearl Nkrumah also indicated that in this new age of doing business, start-ups and SMEs are presented with diverse options and platforms in the digitization space, and could also partner venture capitalists and equity finance companies, after testing the viability of their business with family and friends – this will help make bank loans the last resort.

“It not wise to run to the banks for capital as a start-up business – alternatives abound and it is incumbent on business owners to take advantage of the opportunities and avenues that surround them. Running to the bank will only make you run into debt and eventually collapse your business. It is not advisable for banks to give loans or invest in a business that has a shaky revenue stream. It must not be forgotten that banks are only custodians of other people’s monies and the owners hold them accountable. There are basic available sources of funding that start-ups can tap into and not necessarily seek funding from banks,” she noted.

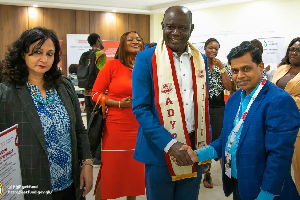

The two-day business summit was organized by the National Board for Small Scale Industries (NBSSI) in partnership with Stanbic Bank. The NBSSI is the apex governmental body for the promotion and development of the Micro and Small Enterprises (MSE) sector in Ghana. The summit was targeted at empowering women in entrepreneurship to offer them access to right information, requisite skill-set, training and mentorship, as well as creating a breeding ground for profitable networking opportunities and prospects for business growth.

The summit was an extension of Stanbic Bank’s entrepreneurship growth project. The Bank through its entrepreneurship programmes has created access to market and funding for SMEs through simplified, relevant internet banking solutions, digitization and advisory services for both the formal and informal sectors, while partnering with institutions like the Lionesses of Africa and the China Europe International Business School (CEIBS) to advance the course of women in entrepreneurship. Other business support projects within the Banks’s SME space include the SBIncubator and Enterprise Direct.

Business News of Wednesday, 20 June 2018

Source: Stanbic Bank Ghana