The nation’s foremost indigenous Oil Marketing Company (OMC), Ghana Oil Company Limited (GOIL) has paid a total sum of GH¢1.128 billion, which comprises taxes and levies to the government during the year 2017.

In spite of making lower than expected volume of sales, the GOIL Group’s financial results were impressive as the group made a net profit of GH¢65.1 million, up by 21 per cent.

The group also increased its earnings per share from GH¢0.137 in 2016 to GH¢0.166.

Lubricant sales performance was 92 per cent of the set target and grew by seven per cent in 2017, compared to the year 2016.

Liquefied Petroleum Gas sales exceeded its target by three per cent, and increased sales by 17 per cent compared to the same period in 2016.

GOIL, however, experienced marginal reduction in the sale of fuel, especially at the retail sector, sale of aviation fuel and bunkering (Marine Gas Oil) were impressive which compensated for the marginal fall in the volume of sales of diesel and gasoline.

According to the financial statement, the shares of the 20 largest shareholders stood at 347,027,776 shares, representing 88.56 per cent; total of the minority shareholders stood at 44,835,352 shares, representing 11.44 per cent.

Government of Ghana holds 134,123,596 shares, representing 34.23 per cent; Social Security and National Insurance Trust (SSNIT) shares stood at 97,965,782, representing 25 per cent; and Bulk Oil Storage and Transport (BOST) shares stood at 78,475,596, representing 20.03 per cent.

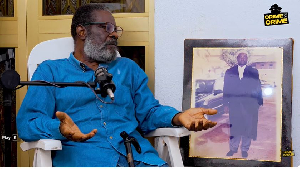

Kwamena Bartels, Board Chairman of GOIL, revealed the financial position of the company at the 49th Annual General Meeting, held on Wednesday in Accra, and affirmed that GOIL remained the biggest company in the country in terms of market share.

He said GOIL achieved its market share of about 20 per cent in 2017, up from 18.2 per cent in 2016, and from all indications, the company is on course to achieve the target of 30 per cent market share by the end of year 2020.

Mr Bartels also revealed that GOIL’s share price has jumped from GH¢1.1 as of December 28, 2016 to an average of GH¢5 as of April this year.

The GOIL Board Chairman said in view of the positive developments, the board had approved the payment of a dividend of GH¢0.028 per share, amounting to GH¢10,972,168 for the year ended December 31, 2017.

He also disclosed that in view of the turmoil witness last year in the trading of the LP gas sector, government had precipitated the need to change regulations on sale of LP gas in the country.

“I am happy to announce that GOIL has been selected as one of the OMCs to lead in the implementation of the change,” he said.

Mr Bartels said GOIL was taking advantage to build three gas-filling plants in Tema, in the Greater Accra Region, Kumasi in the Ashanti Region, and Tamale in the Northern Region.

He said in the downstream sector, GOIL intended to create a niche in the bitumen market by introducing innovative bitumen products that were characterised by durability.

“One additional objective of the bitumen project is to make the product as affordable as possible to contractors, thereby reducing cost of government road projects,” he said.

Mr Bartels also said GOIL has had challenges in terms of adequate supply of lubricants compared to demand.

In this light, GOIL had made plans to build lubricant blending and filling plant to supplement supply.

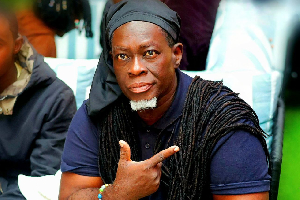

Mr Patrick Akpe Kwame Akorli, Group Chief Executive Officer of GOIL, assured shareholders that the company had put in place measures to recoup about GH¢11 million debt from Metro Mass Transport (MMT).

He said the board, management and staff would continue to adhere to prudent operational practices to compete favourably with multi-nationals in the downstream sector.

“It is in the interest of the nation that indigenous companies take hold of strategic companies in the country,” he said.

On inquisition by some shareholders about the nature of Metro Mass Transport’s indebtedness to GOIL, Mr Akorli assured the shareholders that, “We have entered into new payment arrangement, whereby every week they pay GOIL part of the debt”.

The GOIL 49th Annual General Meeting was attended by a large congregation of shareholders, as well as some members of the immediate-past board, lead by Professor William Asomaning.

Business News of Friday, 27 April 2018

Source: thefinderonline.com