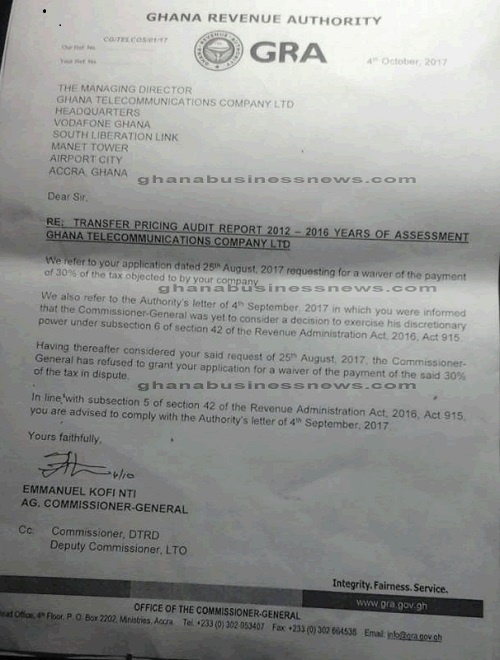

The acting Commissioner General of the Ghana Revenue Authority has refused to grant waiver of the 30% of tax value in contention after a court ordered it to do so in the tax dispute between Ghana Revenue Authority and Vodafone Ghana.

In a letter dated October 4, 2017 the Acting Commissioner-General of the GRA, Mr. Emmanuel Kofi Nti, stated that he will not grant the waiver requested by Vodafone. The Commissioner-General has discretionary powers to grant waivers in tax.

In July 2017, a transfer pricing unit was conducted and an audit of the company from 2012 to 2016 found Vodafone liable of GH¢162,468,361.90 in taxes. But Vodafone disagreed with the GRA’s use of the Technology Transfer Regulations, 1992 (L.I. 1547) instead of the Transfer Pricing Regulations, 2012 (L.I. 2188,) in the audit exercise, court documents shows.

In a back and forth correspondence between the two, the GRA counteracts Vodafone’s assertions by arguing that after subjecting the company’s transactions to the Technology Transfer Regulation 1992, (L.I. 1547), it established that the transactions do not meet the Arm’s Length Test.

Following several meetings to resolve the matter, the GRA asked Vodafone to submit its grievances in writing. That was done through its consultants, KPMG, the document states.

However, Vodafone while waiting for a response from the GRA, it instead received an audit report with the tax assessment of GH¢162,468,361.90 from the Transfer Pricing Unit of the GRA, which demanded that the stated assessment should be paid within 14 days. Vodafone however, objected to the demand.

Business News of Monday, 23 October 2017

Source: ghanacrusader.com