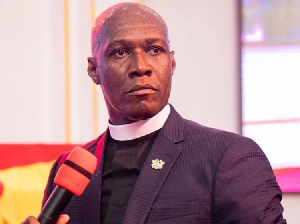

The Monitoring Manager at the Port of Tema, Nii Nii-Koi Amasa has reemphasized that the paperless system currently being practiced will largely make doing business in Ghana quite easy.

However, Nii Nii-Koi Amasa is cautioning that even though the paperless will bring ease to doing business, importers and exporters must be weary of some of their own activities that cause delays in clearing their goods at the Port in order to avert the payment of demurrage and rent charges which end up escalating the cost of their transactions at the Port.

Siting a clear case of a true invoice of an importer. Nii Amasah indicated that about 20% of total cost of import duties are as a result of delays by importers leading to rent and demurrage which are avoidable.

Rent, is the cost that an importer or exporter pays to the Port Authority when a container has been left to sit in the port space after the permitted restricted period. The acceptable stipulated period which does not attract rent charges from the Ghana Ports and Harbours Authority is seven days. Hence, seven days after containers have been discharged from a vessel an importer is expected to pay rent to the Port Authority for the space the container is occupying.

Whereas demurrage, is the penalty paid by an importer for exceeding free time of holding the container/cargo which is often seven days in Ghana but differs from one shipping line to the other as some go as far as 14 days and others 21 days depending on the shipping line in question and the relationship between the line and the shipper.

Nii Nii-Koi Amasa believes that if importers and exporters begin processing of documentations on their goods even before the arrival of the vessel bringing the goods, they can clear within a week of arrival of the cargo and avoid both demurrage and rent charges. Aside avoidance of demurrage and rent charges Nii Nii-Koi Amasa also observed that about 20 percent of the import duties paid by importers and exporters are as a result of excessive and exorbitant but unwarranted unjustifiable charges by freight forwarders otherwise known as clearing agents.

Nii Nii-Koi Amasa said on a typical invoice like this one, where the total charge of taking delivery of cargo is GH¢ 65,000, The importer pays duty and other taxes of GH¢ 44,235 and aside the avoidable demurrage and rent charges that go to the Shipping line and GPHA respectively, a huge part of the remaining other cost to the importer which is about 20% of the total sum is as a result of extortion and squeezing by the clearing agents or freight forwarders.

On this particular invoice, out of total duty of GH¢ 65,000, the importer pays duty and other taxes of GH¢ 44,235, pays avoidable demurrage and rent of 12, 705. However for the other costs, he pays 1, 100 to the shipping line as container administrative charge, pays 1,260 to the Terminal, it could be GPHA or TCT, MPS, APMT or any other Terminal handling the cargo and then pays an agency fee of 1,100 to the clearing agent for facilitating the clearance of the cargo. But the item on the invoice that is raising the contention as well as eyebrows and many calling on government to scrap as a matter of urgency is what is called the miscellaneous charges.

According to Nii Nii-Koi Amasa, unlike the other charges that everyone knows who charges them and for what purpose, the miscellaneous charges are collected by the same clearing agents and according to them are used for photocopies and to settle some faceless officers.

On this particular invoice, whiles all the institutions charge about 1,100, even for using equipment, utility and heavy human resource, the clearing agents charge Gh¢4,500 for what he/she claims to be for photocopies, transportation or illegal settlement of faceless officers and so on. But Nii Nii-Koi Amasa, believes as the nation goes paperless, there will be no need for such exorbitant charges for photocopies of papers. And in a paperless era, where compliance officers’ names don’t even show on any document, agents are not required to illegally settle any faceless officer. Therefore if government means business to reduce the cost of doing business in the Port, as soon as the paperless project is well established, the miscellaneous charge on the invoices should be immediately abolished and permanently prohibited.

He says the country has come too far to continue to keep importers and exporters in the dark side of doing business and if we want to fix the problem, we should not fix some and leave others, but fix it all.

Business News of Monday, 25 September 2017

Source: EOP