Financial institutions operating in the country have with immediate effect stopped charging 17.5 percent Value Added Tax (VAT) on all financial services.

The decision is in pursuant to the Value Added Tax Amendment Law (Act948, 2007).

Banks such as Access Bank, Ecobank, Unibank, CAL, UMB Bank and Zenith Bank, among others, have sent text messages to their customers announcing the abolishment of 17.5 percent Value Added Tax (VAT).

A message from Access Bank to its customers reads: “Please be informed that effective, immediately you will no longer be charged 17.5 percent Value Added Tax on all financial services. This is in pursuant to the Value Added Tax Amendment Act 2007, Act 948.”

Ecobank’s message to its customers recently also reads: “Dear client, the VAT ACT as amended (Act 948, 2017) abolishes the 17.5% VAT on financial services.”

Some stakeholders in the banking sector have lauded government for the amendment of the Act, which resulted in the abolishment of the VAT charge on financial service, stating that the charge hampered the growth of the sector.

The Ghana Revenue Authority (GRA) recently authorized all financial institutions to discontinue charging the 17.5 percent Value Added Tax (VAT) on financial services in the country.

Government, in the 2017 Budget Statement, announced some tax reliefs.

To give legal effect to the policy on VAT on financial services, Parliament passed the Value Added Tax (Amendment) Act, 2017, Act 948 to make the supply of financial services exempt.

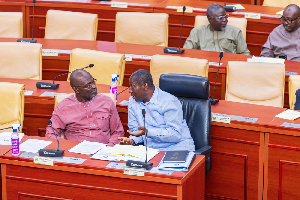

The VAT on financial services was part of the 11 ‘nuisance’ taxes that Finance Minister, Kenneth Ofori-Atta, said the government will abolish when delivering the 2017 budget.

The scrapping and review of the taxes, according to the Finance Minister, is to lessen the burden on consumers and businesses and to boost the private sector which has been identified as the engine of growth.

The cancellation of the taxes mostly affects businesses in the aviation sector, finance sector, real estate industries.

Business News of Friday, 28 April 2017

Source: Daily Guide