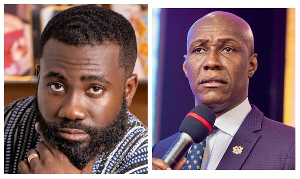

Deputy Minister of Agriculture, Dr Ahmed Yakubu Alhassan has admitted that an institutionalised insurance agriculture scheme will go a long way to improve the agric sector and make it attractive to investors.

Dr. Alhassan said it was about time insurance companies designed policies for the agric sector as the country is experiencing less than 30percent of rainfall than it did a decade ago, which according to him was due to the effects of climate change.

He added that the risks associated with agriculture were high for farmers hence the need for insurers to seriously consider insurance packages for the agric sector.

His comments followed an earlier statement by the Member of Parliament for Nsawam-Adoagyiri constituency, Frank Annoh-Dompreh, who proposed an amendment to the Insurance Act, 2006 to include insurance for agriculture, especially for farmers and their farm produce.

Mr. Annoh Dompreh argued: “Without agriculture, roads wouldn’t have been built, without agriculture hospitals, schools, good drinking water wouldn’t have been there”.

“Mr Speaker, how do you sustain agriculture moving or going forward? One area is agricultural insurance or farmers’ insurance.”

The agricultural sector, which employs a very large proportion of Ghanaians, has performed poorly in the last six years. Last year, the sector grew by 0.04 percent.

This is in spite of the fact that over the past decade, government has implemented a number of important interventions in the agricultural sector to make it attractive to investors. These include buffer stock management, fertiliser subsidies, livestock and fisheries development, irrigation and mechanised systems and the Youth in Agriculture programme.

However, players in the financial sector think these interventions are not enough to woo creditors for which reason they have asked for governments’ intervention to make agricultural financing attractive to lenders.

This, they said, is the way to go to reduce the risk associated with agriculture and get the attention of insurance and finance institutions.

And according to the Deputy Agric Minister agricultural insurance is important and that there is the need to institutionalise a scheme like that.

He said such an insurance scheme should not only be for cash crops but also livestock and poultry because of disease outbreaks that the country has witnessed in recent times with the most recent being the dreaded bird flu.

He continued: “In many cases when these diseases take place, the public purse will have to underwrite most of the losses that are recorded and I believe if we have an institutionalized agriculture scheme all these things will be absorbed by the companies and the public purse will be saved.”

According to Dr. Alhassan, insurance companies were in the past reluctant to provide cover for agricultural activities because of the enormous risks associated with it and that it was against that background that the sector Ministry and GIZ instituted the Ghana Agriculture Insurance Pool (GAIP) four years ago to ensure that agricultural insurance was instituted within the country’s agricultural space.

He indicated: “The Ghana Agricultural Insurance Pool currently exists but there are challenges with funding and discussions are currently taking place between the company and the ministries of Agric, Finance and other donor agencies to see the extent to which these insurance policy could be solved and provided to farmers.”

Dr Alhassan said his ministry is currently collaborating with GIZ on a climate change project risk management: “It started in 2015 and agriculture insurance is an important component of it. “Last year the Ministry in collaboration with the World Bank profiled all the risk associated in the sectorto packaging the agricultural risk in Ghana so that the insurance scheme could be well institutionalized”

“Any move by this House (parliament) to support any legislation that will enhance agricultural insurance in the country will definitely be a move in the right direction. But I do believe the Ministry is working with all these bodies and agencies so that the appropriate policy and legislative approaches could be made to government for approval.”

Business News of Monday, 13 June 2016

Source: B&FT