The latest World Bank ‘Doing Business’ report has revealed that it is more difficult for firms operating in Ghana to get access to credit as compared to the situation a year ago.

Ghana has dropped two places from 112th to 114th position in the latest doing business rankings.

According to the report, Ghana has been lagging behind in terms of improving the environment to make it easy to start a business.

The report, which assesses how the regulatory and business environment in some 189 economies around the globe have been improved to make it easier for entrepreneurs to start and operate businesses, also measures and identifies changes in regulations affecting some 11 specific areas.

These include starting a business, dealing with construction permits, getting electricity, registering property, getting credit, protecting minority investors, paying taxes and trading across borders.

The other parameters are enforcing contracts, resolving insolvency as well as labour market regulation.

The report comes on the heels of a similar one by the World Economic Forum, which said Ghana has fallen by 8 places to the 140th position as far as Global Competitiveness was concerned.

Some analysts have attributed the situation to government’s continuous borrowing from both the international and domestic markets.

This is because investors are more inclined to go for higher interest rate offers from government than the banks.

Government indicated that the numerous loans it was contracting from such sources would be used to pay off maturing government debts.

It is also eyeing the floating of an additional $500 million should market conditions improve since Parliament approved a total of $1.5 billion.

This year, it has planned to borrow GH¢50 billion.

In the meantime, analysts have expressed dissatisfaction with government’s decision to apply all the $1 billion Eurobond proceeds it recently contracted to refinance maturing short-term domestic debts instead of using that to finance infrastructure.

Moody’s Investors Service in October 2015 assigned a provisional rating of (P) B1 to the recent bond issue by Ghana. The bond was enhanced by a partial guarantee of $400 million and 40 percent of the face value of the bond by the International Development Association (IDA, unrated). That gave Ghana’s issuer rating a B3 with a negative outlook.

Ghana’s B3 rating reflects adverse debt dynamics as highlighted by an increasing debt burden.

Also, an earlier negative outlook assigned on 19 March 2015 reflected further downside risk to the country’s debt dynamics and liquidity pressure in the short-term.

The Association of Ghana Industries (AGI) has over the years complained about the difficulty in accessing credit in its Business Barometer surveys, which measures the level of confidence in the business environment and predicts short-term business trends.

In 2013 for example, the survey attributed the occurrence to prevailing rigid requirements demanded by commercial banks in the country.

The survey also cited high utility prices, taxes and high cost of raw materials as part of the 10 topmost challenges to business growth.

Business News of Friday, 30 October 2015

Source: Daily Guide

Access to credit difficult – Report

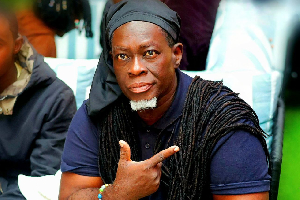

Dr Henry Kofi Wampah - BoG Governor

Dr Henry Kofi Wampah - BoG Governor