Ghana’s inflation has fallen for the 13th consecutive month, landing at an unprecedented 3.8% in January 2026. While the Ghana Statistical Service has been careful to note that this is the lowest rate since the 2021 rebasing—when the inflation basket expanded to 307 items—it is also, in practical terms, the lowest inflation rate recorded since August 1999, when inflation stood at 1.9%. Indeed, the last time Ghana recorded an inflation rate below 5% was June 2002.

These figures should ordinarily be welcomed and celebrated, especially considering that less than five years ago the country was edging toward hyperinflation, ending 2022 at a near 30-year high of 54.1%.

Yet a familiar refrain continues to echo across social media:

“If inflation is so low, why are prices still high?”

That is a fair and genuine question—and one this piece seeks to answer. What Is Inflation?

Picture this.

Scenario 1:

Last Friday, you walked into a nearby kiosk and bought a loaf of soft butter bread for GH¢20. This morning, you return to buy the same bread, only to be told the price is now GH¢30. That is a GH¢10 increase, representing a 50% rise in price. Your bread has recorded an inflation of 50%.

Scenario 2:

Last Friday, you bought the same loaf of bread for GH¢20. This morning, you return and the price is now GHS22. That is a GH¢2 increase, or a 10% rise. Clearly, 10% inflation is lower than 50% inflation. But does that mean the bread has become cheaper? Has the price fallen simply because inflation is lower? We both know the answer.

Ghana's inflation drops further to 3.8% in January 2026

This brings us to the most important point:

Lower inflation does not mean falling prices. It simply means that prices are rising more slowly. Prices that are already high tend to remain high. Your bread does not suddenly become GHS15 because inflation is 2%.

So Why Are Some Prices Still Rising When Inflation Is 3.8%?

This is where the confusion often sets in—especially when utility tariffs are cited as counter-examples. Again, a valid concern.

The answer lies in how inflation is calculated in Ghana.

How Is Ghana’s Inflation Calculated?

Let’s simplify this by using a household example.

Assume that in January 2025, your monthly expenses were roughly as follows:

• Electricity: GH¢500

• Water: GH¢100

• Cleaning services: GH¢150

• Food: GH¢1,200

• Fuel/transport: GH¢1,000

Your total monthly expenditure would be: 500 + 100 + 150 + 1,200 + 1,000 = GH¢2,950

Fast-forward to January 2026:

• Electricity rises to GH¢700 (40% increase)

• Water rises to GH¢150 (50% increase)

• Cleaning services remain GH¢150

• Food rises to GH¢1,500

• Fuel drops to GH¢450

Your new total becomes: 700 + 150 + 150 + 1,500 + 450 = GH¢2,950

Individually, some items have experienced sharp increases—up to 50% in some cases. But when viewed collectively, your total spending has not changed at all. In inflation terms, your personal inflation is effectively 0%.

This is precisely how the national inflation basket works.

The Ghana Statistical Service tracks prices of 307 food and non-food items across 8,337 outlets nationwide. Each item is assigned a weight based on how much of an average household’s income is typically spent on it. The average price change across all these items, weighted accordingly, is what we hear announced as the national inflation rate.

This means that while some items will record inflation far above the national average, others will record much lower inflation—or even deflation.

What the Disaggregated Data Shows

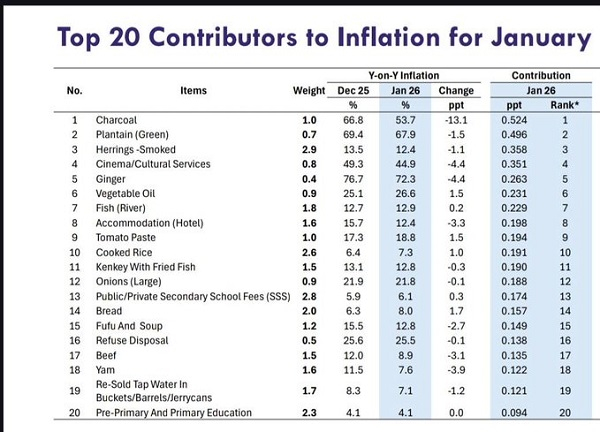

Beyond the headline 3.8%, the Statistical Service publishes detailed item-level data. For example:

• Ginger: 72% inflation

• Plantain: 68%

• Charcoal: 54%

• Cinema and related services: 45%

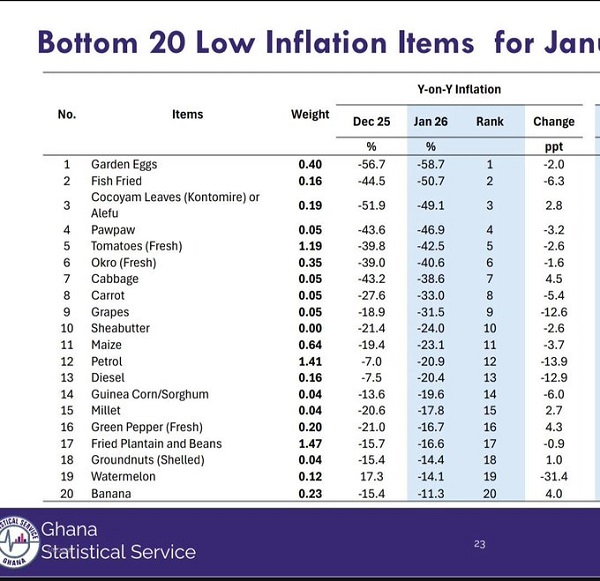

At the same time, several items have experienced deflation—that is, actual price declines. Petrol and diesel is already widely known, but also items such as tomatoes, fried fish, maize, and our very own "kuriya, kuriya" shea butter, have all seen notable price drops over the past year (full list below).

So why do you not “Feel” the 3.8%?

The 3.8% inflation rate is an average across all 307 items. Chances are, you did not purchase all 307 items in a given month. If the items you consume most frequently happen to be those with inflation well above the national average, then naturally, you will not feel relief in your pocket.

So the next time you hear an inflation figure, remember this: It is an average—and you are almost certainly not the “average” person.

Your personal inflation depends on what you buy, how often you buy it, and how those specific prices are moving.

Understanding Ghana's stock market and how to invest | BizTech

Business News of Thursday, 5 February 2026

Source: Edem Kojo, Contributor