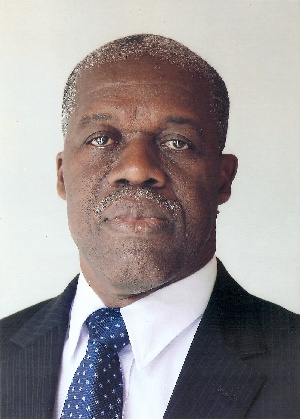

Ghana's economy is currently operating below its potential, Mr. Kwesi Amissah-Arthur, Governor of the Central Bank of Ghana, said in announcing the bank's prime rate. Referring to the Bank's Composite Index of Economic Activity, Amissah-Arthur said current developments pointed to weak conditions in the economy, adding that the sluggish pace in economic activity had implications for economic growth in then on-oil sector in 2010.

According to him, the anticipated slow growth in Ghana's GDP in 2010 implied that the process of fiscal consolidation were likely to be delayed as tax revenue targets might not be achieved.

The governor said the outlook for crude oil prices remained benign and the impact of future spikes from potential crude oil prices to the domestic economy might pose no immediate threat to inflation.

The Bank's Monetary Policy Committee (MPC) maintained its prime rate at 13.5 per cent, citing vulnerability in fiscal outlook.

The prime rate is the rate at which commercial banks borrow from the central bank. A lower rate usually compels commercial banks to reduce their lending rates to the public to spur investment.

Amissah-Arthur, who doubles as the Chairman of the Committee, said: 'The Committee also identified rigidities in the banking sector that inhibit the effective transmission of monetary policy. Of particular concern are the large deposits of some public agencies within the banking system.

'The Committee urges the fiscal and monetary authorities to collaborate to resolve this problem.'

He said the risks in the fiscal outlook were renewed wage pressures from the public sector, adding that wage demands and the expected impact on government expenditures would have to be moderated and managed to ensure that government's fiscal programme remained within acceptable targets.

Meanwhile, he said the Committee expected the decline in the country's inflation over the past 12 months to continue into October 2010 and further into 2011, although at a slower pace as a result of lower food prices and a stable exchange rate.

'These initial conditions are expected to help contribute favourably in ensuring that inflation stays within target. While acknowledging that inflation will ease over the horizon, there are some elements of risks and uncertainties that could impact on the scenario,' he added.

Business News of Sunday, 26 September 2010

Source: Pana