Property investment is a lucrative business that comes with risks and challenges. If you want to amass wealth while minimizing risks with your property, you need to understand the skills of analyzing real estate investment returns.

Are you ready to learn and maximize your income even while you sleep? Join me until the end as I walk you through the essentials you need to know about real estate investment returns.

Understanding Real Estate Investment Returns

What Are Real Estate Investment Returns?

Real estate investment returns, often referred to as ROI (Return on Investment), are the gains or losses generated from investing in real estate properties.

The returns come from various sources including rental income, property appreciation, and tax benefits, among others.

Why Analyze Real Estate Investment Returns?

Analyzing real estate investment returns is crucial for several reasons:

Informed Decision Making: It helps investors make informed decisions when purchasing, holding, or selling properties.

Risk Management: It allows investors to assess the risks associated with specific investments.

Optimizing Returns: By analyzing returns, investors can identify opportunities to optimize their profits.

Tax Planning: Understanding returns helps in efficient tax planning and reducing tax liabilities.

Key Metrics for Analyzing Returns

1. Cash Flow

Cash flow is the amount of money left after deducting all expenses from rental income. Positive cash flow indicates a profitable investment, while negative cash flow may signal potential issues.

2. Cap Rate (Capitalization Rate)

Cap rate is a percentage that represents the potential return on an investment property. It’s calculated by dividing the property’s net operating income by its current market value. A higher cap rate generally signifies a better investment opportunity.

3. ROI (Return on Investment)

ROI is a measure of profit on an investment. It considers factors such as property appreciation, rental income, and expenses. A high ROI indicates a successful investment.

4. Gross Rent Multiplier (GRM)

GRM helps assess the property’s value in terms of its rental income. It’s calculated by dividing the property’s price by the annual rental income. A lower GRM suggests a potentially better deal.

Analyzing Real Estate Investment Returns: Step by Step

1. Set Clear Investment Goals

Define your financial objectives, risk tolerance, and investment horizon. This will guide your investment decisions.

2. Property Selection

Choose properties that align with your goals. Consider factors like location, property type, and potential for appreciation.

3. Financial Analysis

Conduct a thorough financial analysis. Calculate the cash flow, cap rate, and ROI to determine the property’s profitability.

4. Market Research

Research the local real estate market. Understand trends, demand, and potential growth in the area.

5. Due Diligence

Perform due diligence, including property inspections, title searches, and reviewing lease agreements.

6. Financing Options

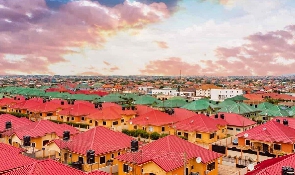

There are several options for financing real estate, including mortgages. At Lakeside Estate, you have three financing options to choose from. They are the mortgage, half payment, and outright payment plans. With any of these, you can invest in any of our 2, 3 or 4 bedrooms. Talk to us today at +233 204775043 or visit our website to learn more.

7. Risk Assessment

Evaluate potential risks, such as economic downturns, property damage, real estate market trends, or vacancy rates.

8. Tax Considerations

You need a tax professional to understand the tax strategies and benefits available and take advantage of them.

9. Property Management

Implement effective property management to maintain and increase property value. Adding a few new things to make living better adds value to the property that needs to increase in income.

10. Regular Evaluation

Continuously monitor your investments and adjust your strategy as needed. Real estate investment is an ongoing thing. Therefore, you should study the market trends and adjust where necessary.

It is imperative for you to acquire the skills necessary to analyze real estate investment returns If you want to maximize your income. You can make concrete decisions and increase your returns if you learn the metrics and continuously evaluate your investment.

Remember that real estate investing requires diligence and patience, but the potential for financial success is substantial.

Talk to us today at +233 204775043 to start investing in real estate with CIMG Real Estate for the year 2019/2021. We are the number one trusted real estate developer in Ghana that you can trust. Visit our office on the 7th floor of the Silver Star Tower in Airport City, Accra.

Advertorial of Saturday, 25 November 2023

Source: lakesideestate.com