Black Friday has become popular in Ghana over the last few years and has fundamentally changed the way Ghanaians in the suburbs shop. While average spending in November seems to get higher than in the first 10 months of the year, it was always well below the traditional festive season trading numbers recorded in December.

In the last six years, however, shoppers have increased spending in November and now spend more in the eleventh month of the year than the average level in the first 10 months of the year, taking advantage of deals and special offers. This has had an impact on December trade, but consumers still spend significantly more in the last month of the year than in the first 10.

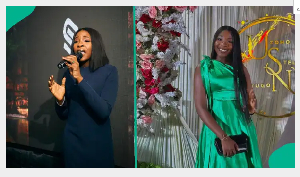

The Head of Retail banking at First National Bank, Akweley Laryea explained that there is certainly a breadth of specials to take advantage of during Black Friday, but the much higher expenditure overall in November and the comparatively slight change in behavior in December would suggest that consumers are just spending much more over the last two months of the year than they used to.

“Certainly, when an unbelievable deal on a new double-door fridge comes along and yours is leaking water and way too small for your growing family, taking advantage of a Black Friday deal makes sense (just make sure to check it is ACTUALLY a good deal). But avoiding spending on a new blouse or a “buy 3 get 30% off” lipstick special could mean that you have cash available to invest,” she stated.

While you can also get caught up in the “buy 5 and get 2 free” mood rings across merchant and retail points, an argument can be made that you will be better off investing on Black Friday than spending. You can consider opening a charge-free savings account or a flexi-fixed deposit to invest if you don’t already have one.

If you do want to take advantage of good Black Friday deals, then make those purchases with your First National Bank Visa card, and get to save some extra cash rewards in your savings pocket in addition to all your investment instruments.

If you do have money for this year’s Black Friday deals, now is the best time to start investing for next year. The interest on your investment can be used to splurge whilst you keep your money intact. Be a savvy shopper who enjoys without breaking their own bank.

“This is the best time to keep track of your cash back rewards for all the transactions you have made with your First National Bank VISA debit card or airtime you have purchased via the mobile App. Your cashback rewards can be found in your savings pocket attached to your account on the App,” she concludes.

Business News of Friday, 24 November 2023

Source: First National Bank