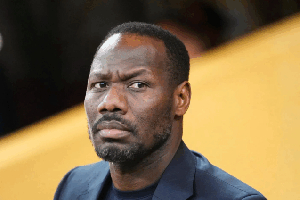

-Commissioner-General

The Commissioner-General of the Ghana Revenue Authority (GRA), Mr. George Vincent Blankson, has stated that bringing the revenue collecting agencies in the country under one centralized command is meant to promote uniformity and harmony and serve as a one-stop-shop process for revenue generation, which is more convenient to taxpayers.

Mr. Blankson stated this to indicate the benefits that bringing three revenue generation agencies, Customs Excise and Preventive Service (CEPS), Internal Revenue Service (IRS) and Value Added Tax Service (VATS) under one command structure under the Ghana Revenue Authority Act this year. He said combining and harnessing the efforts of supporting staff of the agencies, now divisions under the Authority brings with it the benefits of synergies to improve revenue mobilization.

Speaking in an interview on Joy FM’s Super Morning Show hosted by Mr. Kojo Oppong-Nkrumah on Tuesday morning, Mr. Blankson dismissed suggestions that integrating the three agencies, CEPS, IRS and VATS under one umbrella had the potential of stifling specialization.

He said on the contrary, the separated agencies narrowed the scope for specialization.

“It is only when you have combined them that you have scope a (broader) scope for specialization,” he explained. According to Mr. Blankson, the combined structure facilitates easier sharing of information among the divisions, which makes it easier for optimum monitoring of revenue generation in the country. He dismissed suggestions also that bringing the agencies together would result in job losses, adding that the strategy has been to look within and exploit the talents of staff to carry out the various tasks under the reforms.

Mr. Blankson said even though it was mainly the head of the Authority that was visible, processes and structures are being reformed to make revenue collection more convenient both for the taxpayer and the agencies.

He said there are taxpayer-specific services to be provided across the country, including setting up medium and low taxpayers’ units, to meet the special needs of different categories of taxpayers to improve efficiency and convenience to taxpayers as well.

The Commissioner-General disclosed that seminars that the Authority has held have brought together staff of the various divisions, which have helped in breaking down the barriers that existed among staff, who, hitherto saw themselves as working for different entities.

Mr. Blankson said the new structure makes it possible for the command to have an overview of the operations of the various divisions, which complement each other in their functions.

He explained that generally, it is only when people were unsure of the rules that existed that officers took advantage of them.

He said another advantage that the harmonized revenue collection regime brings, unlike in previous times is to have one visit from a team of revenue collecting officials, who assessed a business on its customs and excise duties, value added tax, and income tax, relating them to each other. He said under the current system of operations, a taxpayer uses only one tax identification number (TIN) and that makes it easier to track response to tax obligations.

On relationship with destination inspection companies (DICs), he explained that these are private companies that assisted revenue collectors to value imports. He said the values of the DICs are however, subject to CEPS’ acceptance or review as provided under law.

Business News of Friday, 13 August 2010

Source: The Business Analyst