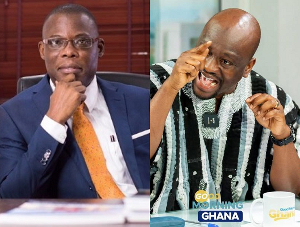

Associate Professor of Finance at the University of Ghana Business School, Professor Lord Mensah is urging the Bank of Ghana to review its strategy of tackling inflation.

Speaking to Starr News ahead of the Bank of Ghana’s Monetary Policy Committee (MPC) meeting starting Wednesday July 19, 2023, the Economist indicated that adjustments to policy rate by the Monetary Policy Committee won’t impact inflation trends.

“We seem to be focusing too much on excess liquidity mop up using the policy rate and you wonder about the kind of liquidity we have in our economy that we are trying to use this policy rate to capture. We all know that it is difficult to come by money now, and there is no excess money following few goods. We may have to look at this carefully.

“I believe that the inflation build up has to do with government spending and how the government controls indicators like taxes and borrowing from the market. So from where I sit, inflation has to do with the fiscal side rather than the monetary side”, Prof. Lord Mensah stated.

He continued: “The monetary policy committee can continue to tussle with the policy rate, it won’t see any impact on the trends in prices.”

However, Professor Lord Mensah is also predicting that the MPC would adjust the policy rate in line with the International Monetary Fund (IMF) programme.

“The economy now has been surrendered under the IMF programme. If we should stick by what the IMF is saying then there would be an increase in the policy rate in the name of arresting inflation while taxes swell inflation from the other side,” he explained.

Business News of Wednesday, 19 July 2023

Source: starrfm.com.gh