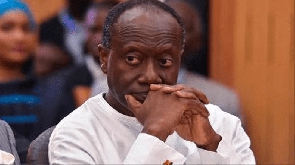

Tax expert and former president of the Chartered Institute of Taxation Ghana, Mike Aflu, has waded into the Domestic Debt Exchange Programme (DDEP) discussion insisting that Ghana does not need an IMF bailout and that Ghana’s economy can survive without their intervention.

Raising concerns about the DDEP, he stated that the decision to restructure government debt could be shelved because it could impact investors' livelihoods and, in the long run, cause economic recession.

"Many of these economic difficulties can be attributed to excessive borrowing, corruption-related activities, rising inflation, the cedi's daily weakening, and so on. On the issue of corruption, it should be noted that, in a letter dated 5th October 2020 from the Auditor-General to the Managing Director of GCB Bank, the Auditor-General demanded to know why an amount of Ghc 52,537,175,778.13 deposited by the Ghana Revenue Authority, which should have been transferred to the Bank of Ghana, was transferred from GCB Bank Plc into an unknown account. My question is, where has the money gone?" he quizzed.

This government could have avoided the 17th IMF bailout Ghana is currently seeking if the Finance Minister had managed the country's debt levels well, among other things like inflation, rise, and excessive spending.

Ghana will struggle to secure the required IMF Management level approval by March 2023, as indicated by the Finance Minister, because there are still outstanding issues with the Domestic Debt Exchange Programs and the yet to be commenced external debt restructuring.

On the alternatives available to managing the economy, government should cut down 50% of its expenditure. Government should take a second look at its recurrent expenditure and do a revision on its cost items to help create some fiscal space. In doing so, the government should also consider deferring 60% of flagship projects that are putting a strain on the economy's finances.

To address the economy's revenue shortfalls, the government should prioritize revenue generation by closing corruption loopholes and empowering the Revenue Authority, GRA, to work more efficiently.

Going forward, the government should be prudent and financially discipline in its governance approach. Government should as a matter of urgency work with the necessary stakeholders to look at dealing with the economic quagmire we are currently in

Business News of Saturday, 25 February 2023

Source: Mike Aflu, Contributor