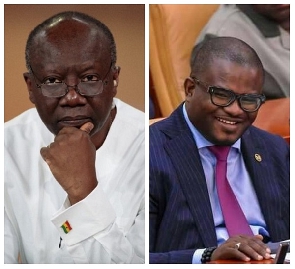

The Member of Parliament for Bolgatanga Central, Isaac Adongo, outlined various reasons the now-former Minister of State in charge of Finance should not be approved in 2021.

According to Adongo, Adu Boahen owned a firm, Black Star Brokerage one of the three advisory firms for government borrowing.

He noted that Black Star Brokerage by Adu Boahen and Databank owned by Ken Ofori-Atta were in to share the spoils from the government’s borrowing.

He said this was the reason the country’s debt levels had skyrocketed since 2017, due to reckless borrowing.

In a video during a press conference in February 2021, he said: “The Ministry of Finance headed by Messers Ken Ofori-Atta and Charles Adu Boahen just announced a list of primary dealers and introduced a new term called Bond Market Specialists. Interestingly, firms owned by these two personalities, Databank owned by Ken Ofori Atta, and Blackstar Brokerage Limited owned by Charles Adu Boahen have been selected as two of the three local investment advisory firms.”

He added: “the duo, Ken Ofori Atta and Charles Adu Boahen have thus literally awarded to themselves through their companies the lucrative contracts that involve managing Government's borrowing program with an estimated GH¢60 billion a year gross financing. The fees to be shared by the transaction advisors of the Government borrowing program, including Ken Ofori Atta and Charles Adu Boahen's companies, are estimated at GH¢210 million a year."

Read the full article below

This press conference was during the vetting of Charles Adu Boahen as minister of state in February 2021. Hon Isaac Adongo made a strong case for him to be rejected by the Appointments Committee of Parliament!

Please read the article and watch the video.

Hon Isaac Adongo unveils the "blood-sucking vampires" at the Ministry of Finance.

If you ever wondered why Ghana's public debt has since 2017 been growing at an unexplained geometric sequence, the reasons are here:

Those in charge of the borrowing, stand to personally profit from the borrowing through the reward in fees to their companies who serve as their transportation advisors.

Whilst the corporate esteem of Ghana is on a nosedive and the future generations are being saddled with a debilitating debt, the worth of companies owned by persons at the forefront of the borrowing decisions keep soaring.

Appointment of Databank and Black Star Brokerage as Transaction Advisors to the Ministry of Finance is a deadly combination of Ken Ofori Atta and Charles Adu Boahen in Motion without shame.

The Ministry of Finance headed by Messers Ken Ofori-Atta and Charles Adu Boahen just announced a list of primary dealers and introduced a new term called Bond Market Specialists. Interestingly, firms owned by these two personalities, Databank owned by Ken Ofori Atta and Blackstar Brokerage Limited owned by Charles Adu Boahen have been selected as two of the three local investment advisory firms.

The duo, Ken Ofori Atta and Charles Adu Boahen have thus literally awarded to themselves through their companies the lucrative contracts that involve managing Government's borrowing program with an estimated GH¢60 billion a year gross financing. The fees to be shared by the transaction advisors of Government borrowing program, including Ken Ofori Atta and Charles Adu Boahen's companies is estimated at GH¢210 million a year.

This is a clear conflict of interest. The Minister for Finance has made the government borrowing his private business and benefit each time Government borrows through Databank either as a bookrunner or Co-Manager of Eurobond issuance.

Ken Ofori Atta's Databank has now been joined by Charles Adu Boahen's Blackstar Brokerage Limited to share the spoils. The combination of this deadly team is set to further engage in reckless borrowing as evidenced in the more than doubling of Ghana's public debt from Ghc120 billion at the beginning of 2017 to about Ghc300 billion by the end of 2020. In addition to the about Ghc180 billion increase in Ghana's public debt, about Ghc70 billion of the end of 2016 debt of Ghc120 billion was refinanced and in some instances reprofiled between 2017 and 2020.

This means that a total of about Ghc250 billion Government borrowing program was carried out in the last four years with Ken Ofori Atta's Databank acting as his transaction advisors. The accrued fees shared by the transaction advisors, including Databank is estimated at 0.35% of the borrowing program of Government. That is about Ghc875 million fees paid by Ghana to these transaction advisors.

No wonder Ghana is bleeding from excessive reckless borrowing without any meaningful benefits to the suffering taxpayers.

This harrowing public debt program was fested on Ghanaians when only Ken Ofori Atta's Databank was involved. I am scared for Ghana when I think of Charles Adu Boahen's Blackstar Brokerage now joining the fray to share the spoils. How big will the Government's borrowing program be to ensure that Databank maintains its fees income from the last four years and leave some spoils for Charles Adu Boahen's Blackstar Brokerage to help itself with?

Since they came to power, there is no bond transaction for government that the Minister didn't benefit personally from through Databank and now Charles Adu Boahen through Blackstar Brokerage.

Charles Adu Boahen who sat and is expected to sit on the Board of Bank of Ghana where Databank and Blackstar Brokerage will be operating from as transaction advisors. He also sat and is expected to sit on the Governing Board of the Securities and Exchange Commission that regulates Databank and Blackstar Brokerage Limited. The bonds and other Government debts to be issued through these companies are also expected to be approved by Charles Adu Boahen sitting on the SEC.

As a matter of fact, any complaints relating to these companies would be directed at SEC on whose Governing Board sits Charles Adu Boahen and controlled by a former Vice President of Databank, Rev Ogbamey Tetteh who masterminded policy rollout that has collapsed the securities sector of Ghana.

Where lies the independence of the dealers and advisers to government on borrowing. Are decisions about borrowing and interest cost being made in the interest of Ghana or private businessmen? Sheer and crude profiteering at the expense of Ghanaians. Always promoting their firms and personal interests.

How do we protect against insider trading when the very people taking decisions on interest rates and bond structuring are themselves direct beneficiaries of the outcome of their decisions through their companies?

Ghana has been bleeding and I fear it will bleed even more with Ken Ofori Atta and Charles Adu Boahen now hand-holding the interests of Databank and Blackstar Brokerage.

Who watches the watchman?

Watch the latest episode of BizTech below:

SSD/FNOQ

Business News of Tuesday, 15 November 2022

Source: www.ghanaweb.com