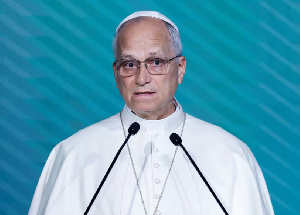

Bank of Ghana Governor, Dr. Ernest Addison, has expressed commitment to restoring order and bringing stability to the country’s foreign exchange market through stringent measures. According to him, despite disruptions in the general economy across the world, coupled with inflationary pressures, demand-supply imbalances, and uncertainties in the financial markets among others, the central bank is poised to collaborate with relevant stakeholders toward stabilizing the foreign exchange market. Speaking during a meeting on October 26 with stakeholders within the foreign exchange market, heads of banks and the Association of Forex Bureau Operators, Dr. Addison underscored the importance of sanitizing the market to address shortfalls and curtail the cedi’s decline. “Available data indicate that we started the year GH¢6 to the dollar. It got to GH¢7 and we stayed at GH¢7 in June, GH¢7.6 in July, GH¢8 in August, GH¢9.6 in September and now it is GH¢12.5. But we are here again with people sending messages that the dollar-cedi rate is GH¢15 to a dollar," he noted. “Clearly, this type of movement does not reflect changes in the fundamentals. It is clear that the market is not functioning properly. We are seeing speculations taking over under very disorderly market conditions and it appears now the black market is rather driving exchange rates. This we cannot allow to continue,” the BoG Governor added. Touching on measures to reduce soaring inflation rates in Ghana, Dr. Addison said the central bank will continue to adopt tightening of monetary policy to prevent inflation from being entrenched. He however pointed out that monetary policies should be complemented with fiscal policies for every economy. Dr. Addison however admitted to recent developments in terms of liquidity in the banking sector but indicated that the Central Bank currently has some liquidity in place. “I am aware of the recent developments in terms of liquidity in the banking sector. As I said, I took note of the advice from Washington on the financial stability issue that there has to be targeted liquidity support to preserve financial stability without undermining the inflation control objectives. So, this is really the context we should have the discussion on all the complaints of we need liquidity and BoG not supplying liquidity,” the BoG Governor explained. “As we are all aware, we got the $750 million from the AfriExim Bank and I think on [October 26, 2022], we are supposed to receive the $790 million from the COCOBOD syndicated loan so the Central Bank has some liquidity.” “We have enough liquidity to keep things relatively stable till the International Monetary Fund Programme kicks in and the financing assurances expected from other partners come in,” he added. He continued, “I recently met the CEOs of banks and I have assured them that we will provide the necessary liquidity to ensure that we do not have a banking system with a liquidity problem and we have to do that within the context of keeping inflation low.” Debt sustainability concerns Meanwhile, the leadership of banks present during the engagements blamed the development on the rapid depreciation of the cedi against the US dollar on a wide range of issues. They prominently attributed the challenges to uncertainties surrounding the future of Ghanaian bonds especially. The heads of banks also said the ongoing negotiations between government and the International Monetary Fund (IMF) have fueled certain speculation over Ghana’s debt sustainability position and forced some banks to begin cutting losses and moving their investments into safe havens. To address the situation, they urged the Bank of Ghana to employ adequate mechanisms to regularise forex brokers in a way that would ensure their efficient supervision and prevent the sale of foreign currencies at exorbitant prices. The BoG Governor in his response assured stakeholders it was adopting measures to address challenges in the financial sector and particularly restore order in the forex market. “We are going to this by making sure the interbank market took full control of the forex market to enforce regulations surrounding forex trading so as to streamline the supply of forex in the country.” ’Black Market’ operations The Association of Forex Bureau Operators on their part lauded the Bank of Ghana for its resolve in clamping down on illegal forex dealers also known as ‘Black Market’ operators. They believe that ongoing efforts will help sanitise the sector and ensure only licensed forex operators can engage in exchange transactions. MA/FNOQ Watch the latest episode of BizTech below:

Business News of Friday, 28 October 2022

Source: www.ghanaweb.com