Business News of Monday, 2 November 2020

Source: goldstreetbusiness.com

Record sized Eurobond issuance to start 2021

The Government of Ghana is looking to issue a record high amount of Eurobonds early next year in an effort to secure its extraordinarily high fiscal deficit financing needs while at the same time raising finance to refinance impending large Eurobond maturities.

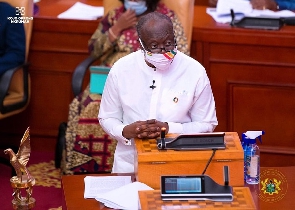

According to Finance Minister, Ken Ofori-Atta, Ghana is willing to go as high as US$5 billion in new issuance for 2021 although it has set a base amount of US$3 billion. How much will actually be taken will depend on market conditions.

Instructively however government has given an expenditure allocation for US$5 billion but not for US$3 billion indicating that it has set its sights on the higher amount.

Just as instructively the request to Parliament for approval has been made alongside request for approval for appropriation with which to run the government’s activities during the first quarter of 2021, which means it intends to issue the bonds during the first quarter and not later.

This is prudent; as the global economy recovers from the worst effects of COVID-19, monetary easing will be decelerated which means global interest rates will begin to rise.

Ghana is expecting to issuance its bonds next year before this happens and so lower its borrowing costs accordingly. Instructively last year’s issuance was done on the best terms Ghana has obtained from the international capital markets to date even though it was done just before monetary easing began.

The thinking at the Ministry of Finance therefore is that even better terms could be secured at the start of next year.

Last year Ghana issued its Eurobonds in three separate tranches. One was for 40 years, with US$750 million taken at 8.875 percent.

Another was for 14 years with US$1 billion taken at 8.6 percent. The third was for six years with US$1.25 billion taken at 6.375 percent.

At the time, interest spreads on emerging market sovereign bond issuances averaged 307 points over United States treasuries up fromm291 points at the start of the year.

Monetary Easing by the US Federal Reserve Bank has seen those spreads rise further and banks liquidity support for countries facing the coronavirus challenge has created an attractive funding environment for high-rated issuers, Moody’s Investors Service claims in a recent report.

Emerging Market debt issuers brought a total of US$488 billion worth of Eurobonds to market between the first and third quarters of this year, which suggests that last year’s US$590 billion total is set to be overtaken amid ample liquidity conditions for high-rated issuers.

The snag though is that sub Saharan African countries are not being regarded as high rated under the current circumstances.

While the Middle East accounted for just over a third of Emerging Market sovereign issuance in the first nine months of the year, as the region’s governments bolstered their finances against a backdrop of subdued energy prices and weaker tourism, by contrast, Sub-Saharan Africa eurobond volumes have dried up, with no new issuance at all in the third quarter of this year.

However, Ghana is generally regarded as an exception when it comes to quality of macro-economic management; its 2020 sovereign bonds issuance was five times oversubscribed.

At current rates, even a 400 basis points margin over US treasuries would allow Ghana to borrow cheaper than early this year. Indeed it is this scenario that is encouraging government to go for a record high amount from the international capital market.

The Finance Minister has disclosed that US$3.5 billion out of the US$5 billion being targeted would go into liability management, which means debt re-profiling and here the target is both longer maturities and lower coupon rates.

But the more revealing aspect of the impending issuance is the US$1.5 billion to be used for budget support in 2021.

This would be the largest new debt taken by government through a single Eurobond issuance and reflects the pressures being incurred by two extraordinary fiscal deficits in a row, of 11.4 percent for 2020 and 8.6 percent for 2021.