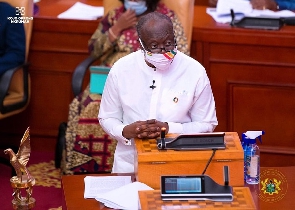

On Wednesday, October 28, 2020, Finance Minister, Ken Ofori-Atta, presented the budget for the first quarter of 2021 to Parliament.

He asked Legislators to approve GH¢27.4 billion mainly for recurrent government spending and payment of interest on loans for January to March 2021.

Below are some of the key things contained in his budget presentation:

HIPC is behind us

The Minister told Legislators that Ghana’s status as a Highly Indebted Poor Country (HIPC) had ended in response to suggestions by the opposition National Democratic Congress (NDC) that the country’s current economic conditions are similar to when it joined the HIPC programme.

“Economic mismanagement is behind us. The economy is stronger today than it was 4 years ago, and will continue to grow stronger and stronger with 4 more years to do more for the people of Ghana, with God’s help,” Ofori-Atta said.

Parliament has backed the Ministry of Finance to pass more than 50 bills

Ken Ofori-Atta made this point in praise of the parliamentarians’ support of the work of the Ministry of Finance.

“I feel truly blessed and have such gratitude to God for the opportunity to have been here in these past four years to work for President Akufo-Addo and to present the President’s remarkable, destiny-changing, economic regenerating, institutional renewing policies and programmes…Together with this Parliament, the Ministry of Finance alone has passed more than 50 bills into law in the last four years. I, and all of the team at the Ministry of Finance, humbly thank you, Mr. Speaker and Honourable members,” he said.

Requests approval of US$3bn/US$5bn sovereign bond

To be able to finance the projected deficit of over GH¢10 billion, the Finance Minister requested to borrow $3 billion – or US$5 billion when market conditions are favourable – to support the 2021 budget and liability management.

“This will comprise the issuance of sovereign bonds of US$3 billion with the option to increase it to US$5 billion should market conditions prove favourable. Out of the amount to be raised, US$1.5 billion will be used to support the 2021 budget and US$3.5 billion for liability management,” he said.

Approval of GH¢27.4bn for govt expenditure

The Minister asked Legislators to approve GH¢27.4 billion to enable government carry on its services until the expiration of three months from the beginning of the 2021 Financial Year.

“The total amount is to cover Government operations, such as Compensation of Employees, ex gratia awards, Interest and Amortisation payments, transfers to Statutory Funds, critical programmes and Goods and Services, and Capex allocations of MDAs,” he said.

Over GH¢10 billion to be used to pay interest on loans and amortisation

In the breakdown of how the GH¢27.4 billion would be used, the Minister revealed that Interest Payments will take about GH¢7 billion (GH¢7,002,221,941) while over GH¢3 billion (GH¢3,419,583,605) will finance amortisation.

Q1 2021 fiscal deficit projected to be GH¢10.7 billion

The Minister revealed that for the first quarter of 2021, the projected total revenue and Grants was GH¢13.3 billion while total expenditure including the clearance of arrears is projected at GH¢24.0 billion. This results in the projected fiscal deficit of GH¢10.7 billion for the period.

Business News of Friday, 30 October 2020

Source: www.ghanaweb.com