The Ghana Union of Traders Association (GUTA) is protesting what it calls unfair competition from players in the e-commerce space, due to failure of tax authorities to levy them appropriately.

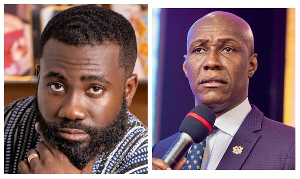

According to GUTA President, Dr Joseph Obeng, “online traders are in serious competition with people who do physical trading in the markets. If care is not taken those who are paying taxes and can be visibly traced will lose their jobs.”

While calling on government to employ strict digital means to capture and track all traders into a server so that they could be easily located, Mr Obeng said “the technicians should have a way to deal with it and register those people who do online trading and find a way to monitor them, otherwise there is a huge chock of resources in there.”

The GUTA Boss said e-commerce was an indirect competitor to traders in the markets as they do not create legitimate access but derive almost the same income or even more than shop owners.

“Doing the same business with someone and paying more than you do is unfair. Put them all in competition and have them pay equal taxes,” he maintained.

To date, online shoppers continue to enjoy tax-free sales on items from e-commerce sites. Some online businesses had attracted customers across the globe and potentially increasing market shares.

Unlike physical shops that work within some limited time frame, sales on e-commerce platforms can be made at any time of the day or night which increases the likelihood of making sales.

In the wake of the COVID-19 pandemic in Ghana, businesses are gradually changing communication channels by patronizing e-commerce activities; giving it prominence among retailers and consumers.

The rapid shift in the business model had left a strain on businesses that have a physical presence in the market and were taxed yearly.

Dr Obeng said he was expecting government to capture people who trade online into the tax net.

He indicated that Ghana was losing millions in revenue as it lacked the required data to tax online companies and monitor their activities.

In times of the pandemic, it had also reduced the need to have physical contact with shop owners reducing the risk at which the virus could be spread.

Business News of Friday, 7 August 2020

Source: thefinderonline.com