Bank will continue to ease their credit stance on loans to enterprises in the coming month, the latest credit conditions survey by the Bank of Ghana for June 2020 forecasts.

The survey showed a net ease in the overall credit stance on loans to enterprises for the months of June and July 2020, following the previous tight stance reported in April.

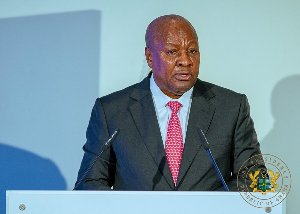

The Governor of the central bank, Dr. Ernest Addison said, “Banks are projecting a net easing in the credit stance on household loans along with further easing in the credit stance on loans to enterprises in the next two months.”

In line with this, new advances grew by 30.4 percent year-on-year to GH¢15.8 billion by end-June 2020.

Lending rates

The weighted average interbank lending rate, that is, the rate at which commercial banks lend to each other, declined to 13.8 percent in June 2020 from 15.2 percent in the corresponding period of 2019.

This, Dr. Addison noted, reflects the monetary policy easing measures to inject liquidity into the banking system.

Similarly, average lending rates of banks declined from 24.1 percent to about 22.0 percent over the same period.

Deposit Money Banks (DMBs) Credit Developments

“Deposit Money Banks (DMBs’) credit to the private sector slowed in June 2020 on account of elevated default risks and moderated demand for credit, reflecting the impact of the COVID-19 pandemic on the real sector,” the Governor indicated.

Annual growth in private sector credit declined to 12.4 percent in June 2020 compared with 16.8 percent growth in the same period of 2019. In real terms, private sector credit expanded marginally by 1.2 percent compared to 8.6 percent in June 2019.

The three major sector beneficiaries were Services; Transport, Storage and Communication; and Agriculture, Forestry and Fishing, which together accounted for 94.1 percent of the credit flow over the 12-month period to June 2020.

Business News of Wednesday, 29 July 2020

Source: goldstreetbusiness.com

Banks ease credit stance for enterprises

Entertainment