One of the leading financial services companies in the country, afb (Ghana) plc, has reported significant improvement in its profit before tax for the 2016 financial year.

This was announced when the company took its turn at the “facts behind the figures” session at the Ghana Stock Exchange (GSE), in Accra.

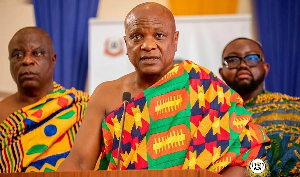

Speaking at the event, the Managing Director, Arnold Parker said, “the 2016 financial year has been a great one for the business compared to 2015”. As stated last year, he noted, “our attention for 2016 was to focus on Balance sheet growth to increase profitability. Profit before tax increased by GHC 7 million with a 30% growth in our loan book representing over 300% increase for the business.”

In an era when most financial institutions are struggling with high levels of non-performing loans, high operating costs and slow business, afb Ghana seems to be riding the storm.

Mr. Parker further asserted that the important highlight of 2016 was the 100% sale of afb Ghana to Letshego Holdings Limited, a Botswana based financial services group with presence in 10 other African countries. He added that

“Letshego has a strategic intent to become Africa's leading inclusive finance group. “The transaction has been approved by the Bank of Ghana and is currently pending Securities and Exchange Commission (SEC) approval”.

The Head of Finance and Administration, Ibrahim Obosu, also speaking at the event, stated that the steady improvement in revenue was supported by the introduction of new innovative products, expansion of branch network and the rigorous measures put in place to control expenses. Interest income for 2016 increased by 16% with provision decreasing by 14% year on year.

afb Ghana’s operating income shot up by 45% as compared to the previous year’s which operating expenses witnessed a marginal increase of 15%. This obviously accounted for the strong performance of the company.

He continued, “we are confident about 2017 and the business prospects for the remaining financial year. We will continue to focus on balance sheet growth and profitability in 2017, with special attention pointed to the introduction of more innovative products and technologically driven sales channels on the market.”

It will be recalled that afb listed bonds on the GAX in 2015 to restructure its balance sheet. There’s every indication that this strategic move has turned around the fortunes of the company significantly.

afb operates as a non-bank financial institution providing innovative financial service products to both public and private sector salaried workers through its 25 branches nationwide. afb Ghana is one of the largest Payroll Lenders in Ghana with a portfolio of over 80,000 customers.

Business News of Friday, 24 February 2017

Source: afb Ghana

afb Ghana delivers on promise, records significant growth in 2016

Entertainment