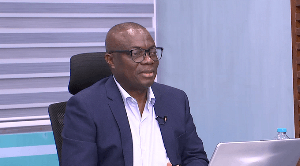

Government’s bid to broaden the tax base to maximize its revenue will not yield the right results if revenue collection authorities keep to their intimidating and unfriendly approach, the Chief Executive Officer of Global Access Savings and Loans Company, Enoch Donkor has said.

“When it comes to broadening tax net, I really would want government to check the tax collecting authorities. The manner some officials go about collecting revenue from the private sector is too intimidating.

Sometimes officials go threatening with force to lock or close down especially small businesses for nonpayment/ noncompliance. When that happens you find out that some business owners always try to avoid paying their taxes. This is not a friendly approach especially in an economy people where people seldom understand the tax system,” Mr. Donkor said.

Speaking to the B&FTahead of tomorrow’s budget presentation in parliament, Mr. Donkor argued that government’s desire to ease the tax burden through various tax cuts means the government need to expand the tax base in order to make-up for any shortfall that may arise.

Mr. Donkor reiterated that the government’s desire to abolish some taxes is a good move and that strong alternative measures must be put in place including getting people or businesses to cultivate the habit of regularly paying their taxes to make-up for any revenue shortfall the tax cuts may lead to.

According to the International Monetary Fund (IMF), after concluding a staff visit to the country last month said the country last year recorded a fiscal deficit of about 9 percent and this larger than expected outcome could be attributed to expenditure overruns as well as non-oil revenue performance.

Given the underperformance of revenue, the Akufo-Addo-led administration promise of cutting some taxes come as a paradoxical approach to boosting revenue although the New Patriotic Party (NPP) government maintains it is a move they have previously undertaking in the past with overwhelming response.

The Fund after meeting with government officials bought into the new approach where tax cuts is expected to lead to higher revenue which is expected to put the country back on the road to fiscal consolidation.

“The new government has expressed its intent to continue with the current program with the IMF. Officials outlined bold policies to restore fiscal discipline and debt sustainability and also to support growth and private sector development.

The large fiscal slippages observed last year will, indeed, require strong efforts of fiscal consolidation to support debt sustainability.

The new government’s intentions to reduce tax exemptions, improve tax compliance and review the widespread earmarking of revenues should help in this regard,” the Washington-based lender said amidst other measures of restoring the country’s economy to its rightful path.

Business News of Wednesday, 1 March 2017

Source: thebftonline.com