Islamic finance enthusiasts in Ghana have been urged to explore ways of kick starting operations in the short term as efforts to achieve a fully fledged Islamic banking and finance ecosystem gathers pace.

This could entail teaming up with conventional banks to open windows – which will serve as a roll out of sharia-compliant products for people who are interested in the ethical finance industry.

The call to start small with Islamic products was made by Zunaiba Abdul Rahman, an MSc and PhD researcher in Islamic finance. She delivered a paper during a recent webinar organized by the Islamic Finance Research Institute of Ghana, IFRIG.

She spoke on the topic: "Sharia Compliance Disclosure: Empirical Evidence From Islamic Financial Institutions."

"Ghana must start something on Islamic finance. It could be the opening of Islamic finance windows in conventional banks for people who are interested. It is very important to take off small.

"Of course the long term dream of establishing a fully functional industry will remain and will benefit from how such small starts go in the short to medium term," she stressed.

On the subject of her presentation, she outlined how most Islamic banks across the world were implementing sharia compliance disclosures and the extent to which regulations in different jurisdictions impacted such disclosures.

Her paper predominantly surveyed banks in the Arab world, the few exceptions being banks in the United Kingdom and Nigeria. In the case of Nigeria, she examined how the pioneer Islamic bank, Jaiz, was faring.

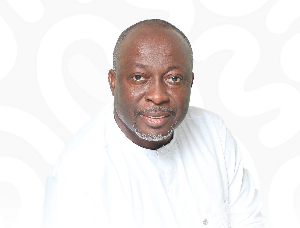

A second speaker on the webinar, Prof Naail Mohammed Kamil Dangigala – a lecturer with the Kwame Nkrumah University of Science and Technology, KNUST – also emphasized the point about starting however small.

He further advocated that interested persons could come together to form financial cooperatives that implement principles and practices of Islamic finance.

The webinar forms part of IFRIG's advocacy efforts in spreading the gospel of Islamic banking in Ghana. Aside webinars, the institute also holds training programs especially in the area of research. A recent research training pooled together major actors from different stakeholders in the wider financial ecosystem.

The training was held at the Durra Institute in Accra and was led by Director General and head of research at IFRIG, Shaibu Ali. He is currently a PhD fellow with the Jiangsu University in China.

Participants were taken through the process of developing a research topic, carrying out feasibility analysis and developing a proposal to back the study.

The area of implementation and execution of research was also expanded on as well as report writing and presentation. In all, there were 20 participants attending along with a dozen IFRIG executives.

"We were very motivated by the response when we put out notices for this training. Especially because people in relevant industry institutions had expressed interest in the program," Ali said.

Business News of Thursday, 18 February 2021

Source: www.ghanaweb.com

Use banking ‘windows’ to kick-start Islamic finance in Ghana – Researcher

Entertainment