THE UNITED Bank for Africa (UBA) Ghana Limited recorded a profit-before-tax of GH¢30.2 million against GH¢13.9 million in 2010, its financial records for 2011 has stated.

Representing an increase of 143 percent over the previous year’s figure, the bank’s profit-after-tax also increased from GH¢9.2million in 2010 to GH¢22.4 million.

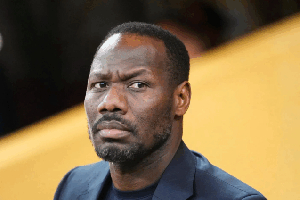

Oliver Alawuba, Managing Director/CEO of the bank, who made this known, said deposit volumes increased to GH¢404.6million from GH¢311.2million the previous year.

He said a decrease in interest income margins last year presented an opportunity for the bank to go into fees and commissions. About 57 percent of the bank’s income during the 2011 financial year came from fees and commissions.

The bank also reduced its non-performing loans (NPLs) from 19 percent in 2010 to 7.91 percent during the 2011 financial year.

“We have been able to reduce the bank’s NPLs through our collective effort, and I can say that by the end of the year, it will be reduced further to about 5 percent,” Mr. Alawuba assured.

Commenting on the expectations for the banking industry this year, Mr. Alawuba said: “The operational environment will be different from what pertained last year, because this is an election year. The inflation rate is going down and the margins are coming down as well. These are the realities of 2012.

“With such realities, harsh as they may look, we should be able to use our skills to find a way of doing our business. We will remain focused, and improve our operations and customer service. UBA is also strong in electronic banking, and this will help us serve our customers better and attract new ones.”

He indicated that the bank will support the agricultural sector as part of its measures to diversify its loan distribution for 2012 to include commodities, public-sector business and telecommunications.

The move will see the bank finance commodities such as cocoa, by providing financial assistance to Licensed Buying Companies (LBC) engaged in the purchase of the cash crop as well as farmer associations. The bank further hopes to extend its assistance to shea-butter and cotton cultivation.

“Fortunately for Ghana, it has a well-established mechanism that is bankable for cocoa. We want to enter that value chain. The cocoa business is well-structured and makes it easier for banks to get into the sector. We will support the LBCs and that will also translate into support for farmers.”

Explaining the rationale for the bank’s decision to go into public finance, Mr. Alawuba said: “For Africa to develop there must be that uniformity of purpose between the private sector and the government in terms of infrastructure development. Most African countries are not doing very well in that regard. The problem is that in time past, government did not understand the private sector and vice versa. But it is important that banks assess and help finance some of these critical projects.”

Mr. Alawuba further stated that “UBA has a lot of capacity that it can leverage on, given the number of countries it operates in, to provide some of the critical infrastructure needed in the country. UBA has no problem of capacity; the UBA group can support us to undertake big-ticket transactions here in Ghana.”

UBA Ghana, a subsidiary of United Bank for Africa Plc, one of Africa’s leading financial institutions, has 26 fully-networked branches and 40 Visa-enabled ATMs spread across Accra, Tema, Kumasi, Takoradi and Aflao.

Business News of Friday, 13 April 2012

Source: Daily Guide