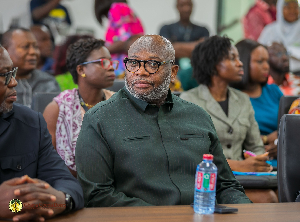

The lessons of money management are best learned when young, says Nana Dwemoh Benneh, the Head of Personal and Business Banking, Stanbic Bank.

Nana Benneh said by teaching children about money, how best to use it and the value of saving, we gave youngsters vital money-lessons that would carry them through life.

“Encourage children to put away money they get as gifts from relatives, and to save the seemingly insignificant coins, impressing on them that these coins, when added up, will get them that so-wanted item,” he said.

Nana Benneh, who was speaking on how to encourage children to save, said the Stanbic Bank’s Pure Save Account was a good way to encourage the child to save.

The account operates in a simple way, teaching children the basics of transacting on an electronic account. Introducing a child to electronic banking with a transaction card of their own helps them to learn about money management and how to use a debit card.

All one needs is a minimum of 50 cedis to open a savings account with Stanbic. You also get a debit card which can be used at ATMs and point-of-sale terminals nationwide.

A savings of more than 500 cedis starts earning incredible interest per annum, meaning that the money grows faster and you reach your financial goals quickly.

Nana Benneh said if you had between 500 and 1,000 cedis in your account, you earned 0.50 % interest per annum. Savings between 1,000 and 10,000 cedis attracted two per cent interest per annum. You could earn as much as six per cent interest if you were able to save 500,000 cedis and above.

“Teaching children to pay themselves before they pay anyone else is the key to a bright future,” he said, adding “encourage them to put a defined sum away at the beginning of every month.”

"The PureSave Account is a good product to introduce your child to the concept of saving over the long term. It pays interest on even the smallest balance. Interest is paid on a tiered basis so the more you save the more you earn. Your money is available whenever you need it and you can deposit any amount at any time.

“One of the best ways to get your child to appreciate the value of money is to get them to earn some themselves. Earning money is a matter of pride, so encourage your child to get a part-time or holiday job. A child then begins assigning a value to acquiring things and balancing the need for an item against the hours that need to be invested to achieve the objective,” said Nana Benneh.

He said children who had learned the basic disciplines involved were more likely to become young adults who understood money, could manage it correctly and handle it effectively to their ultimate benefit.

Business News of Tuesday, 22 September 2015

Source: GNA

Teach children to save - Nana Benneh

Stanbic Bank logo

Stanbic Bank logo