Standard Trust Bank officially changed its name to United Bank of Africa (Ghana) Ltd yesterday, at a ceremony attended by the Vice President, Alhaji Aliu Mahama.

The Nigerian-owned bank, which was the first Nigerian bank to enter the Ghanaian market and the first bank in the country to receive its license under the new 2004 Banking Act, has been operating in Ghana since January 2005.

A merger between UBA and Standard Trust means that UBA now owns majority shares in the company. The transaction, the first successful merger in Nigeria"s banking industry, means that UBA is now the largest bank in Nigeria, and consequently the sub-region.

As well as over 500 branches in Nigeria and six in Ghana, it is the only African bank to have a branch in New York, and also has a branch in the Cayman Islands.

Speaking yesterday at the official launch of UBA Ghana Ltd, at the bank’s headquarters at Heritage Towers, Ridge, Board Chairman Kwame Pianim reassured customers in Ghana that the merger will bring only benefits to this country.

There are now seven Nigerian banks operating in Ghana - all of which have set up in the last three years. Out of a total of 24 banks, some have expressed fears of a Nigerian take-over of our banking industry.

But, "we should not let those who fear competition hide behind blind nationalism,” said Mr Pianim – assuring stakeholders that the nationality of the bank’s owners would have no bearing on its services or principles, anyway. “All banks, irrespective of the majority shareholders, are firmly under the jurisdiction of the Bank of Ghana.”

Paul Aquah, Governor of the Bank of Ghana, also spoke of the advantages of the Nigerian entrance onto the stage of Ghanaian banking. The Central Bank is committed to building a “robust, diversified and globally competitive banking sector capable of meeting the developmental needs of the economy.”

New players on the market, particularly big players such as UBA, who have a balance sheet of over $7 billion, will increase competition in the industry – forcing all banks to provide better services.

More branches, more favourable lending terms, and more user-friendly accounts will be some of the benefits of an increasingly healthy banking industry – as well as more available funds for development.

Alhaji Mahama was the Guest of Honour at the ceremony, and unveiled the company’s new logo. Addressing the gathering, he gave some pointers to the banking giant – to concentrate not just on lending and on services for the corporate big wigs of Ghana’s economy, but rather on the micro and small-scale enterprises which could be the real driving force of our growth.

Already, as Standard Trust, the bank has challenged other financial institutions in Ghana on this front by introducing the first zero-deposit or “cashless account” – allowing those with little or no money to open an account, with no minimum amount deposit required.

Other fresh ideas have included SMS/mobile banking and an initiative called Text Me Cash, by which any Standard Trust customer can transfer money using their mobile phone to any other recipient. All those services will continue under the new UBA name.

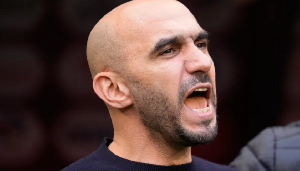

UBA has a target to “democraticise” banking, bringing financial services to the previously “unbanked,” according to Tony Elumelu, Managing Director of the UBA group, who insists that their goal is sub-regional development and co-operation.

A celebrated businessman, Mr Elumelu recently took the African Investor magazine’s 2006 African Businessman of the Year award.

In 2005, Standard Trust won the Competitive Pricing award at the Ghana Banking Awards and placed second in the Retail Banking category. Under its new corporate identity it hopes to build on this success.

Business News of Tuesday, 23 January 2007

Source: Statesman

Standard Trust Bank is now UBA

Entertainment