The Management of the Suhum Rural Bank Limited has been advised to dedicate themselves to their work and treat their customers with respect.

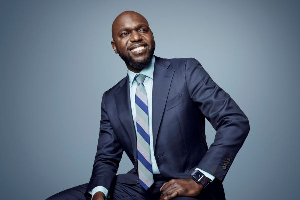

Mr Antwi-Boasiako Sekyere, Eastern Regional Minister, said this during the opening ceremony and sod-cutting of the Suhum Rural Bank Limited.

He said government encourages and supports the establishment of rural banks to make the needed credit available and accessible in the rural areas on reasonable terms.

Mr Boasiako said rural banks would encourage the habit of savings to encourage wealth creation and easy access to loans.

Mr Raymond Amanfu, Director of Other Financial Institutions Supervision Division (OFISD) of the Bank of Ghana, said the rural banking industry, a sub-sector in the financial sector of the Ghanaian economy, continued to grow in terms of members, asset size and deposits.

He said it was the desire of the Central Bank to broaden the financial intermediation spectrum using rural banks to link up the unbanked population, especially small and medium scale enterprises (SMEs) with financial service providers.

Mr Amanfu said access to credit posed a serious challenge to SMEs and urged the management to take proactive steps to identify the credit needs of their clients and provide the needed financial support in an effort to grow them into viable entities.

He advised the management of the bank to operate within the laws of the Bank of Ghana and be mindful of branch expansion since that should be done with the Bank of Ghana’s approval with adequate capital, high caliber of staff and strong information technology infrastructure.

Mr Amanfu encouraged both board and management to adopt corporate governance practices that would help identify, control and mitigate risk assessment with operations.

He said improvement in the quality of human resource would grow the bank and cautioned staff against unethical banking practices.

The Chief of Suhum, Osabarima Ayeh Kofi, asked the indigenes to collaborate with the bank to help develop the area.

Business News of Sunday, 3 August 2014

Source: GNA

Rural banks urged to treat customers with respect

Entertainment