Business News of Wednesday, 13 August 2025

Source: thebftonline.com

Recapitalisation efforts 'meaningless' if high non-performing loans persist

Should the government ring-fence and repay billions in legacy debt owed to contractors, service providers, and independent power producers (IPPs), the domestic banking sector could strengthen its capital base and cut high non-performing loan (NPL) ratios.

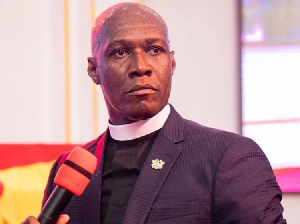

A new policy paper study by banking consultant Dr. Richmond Atuahene cautions that persistent arrears, coupled with macroeconomic instability, continue to keep NPLs well above the 10 percent threshold considered acceptable in global banking.

Data from the Bank of Ghana (BoG) shows that the NPL ratio stood at 23.6 percent in April 2025, down slightly from 25.7 percent a year earlier but still far from the central bank’s target of reducing it to 10 percent by December 2026.

Thus, the paper calls for urgent repayment of GH¢35billion – around 5.8 percent of gross domestic product (GDP) – for non-energy sector debt and US$1.6billion, or 2.8 percent of GDP, energy sector arrears.

Without this, Dr Atuahene argues that any recapitalisation would be “meaningless”.

He also urged the Ministry of Finance (MoF) to ring-fence the debt and agree on fixed monthly repayments to clear the backlog.

The study notes that high inflation, currency depreciation, and elevated interest rates over the past decade have eroded borrowers’ repayment capacity. Much of the banking sector’s NPL problem stems from a mix of government arrears, weak economic conditions, and poor credit risk practices.

Sector data show agriculture has the highest NPL ratio at 62.1 percent, followed by transportation at 53.9 percent, while mining has improved to below 10 percent.

BoG’s plan to cut NPLs includes stricter loan restructuring rules, faster collateral recovery, stronger credit risk governance, and tighter lending controls for repeat defaulters. Governor Johnson Asiama has described the measures as part of a broader effort to “restore asset quality and safeguard stability”.

According to Dr Atuahene, NPLs have averaged over 17 percent during the past decade, with peaks above 22 percent in 2017. This period included the 2017-18 banking crisis, 2022-23 domestic debt exchange, and prolonged fiscal deficits.

The report recommends independent asset quality reviews by international firms, stronger governance in banks, improved internal controls, and tighter credit assessment standards.

Meanwhile, watch the trailer to GhanaWeb’s yet-to-air documentary on teenage girls and how fish is stealing their futures below: