There are indications that the Interoperability for mobile money contract awarded Sibton Switch Systems by the Bank of Ghana is being tempered with and a total cancellation being considered.

And should that happen, it will be a clear case of the Bankswitch issue which landed the state in a huge judgement debt in 2007.

Insider information available to this paper has it that following the recent brouhaha over the award of a contract for the establishment of a national switch to make mobile money payments and other transfers interoperable, the Bank of Ghana decided to subject the contract to another review even though it had long been signed and sealed.

It is unclear what the Vice President’s office which was petitioned over the matter, might have suggested to the BOG which by the country’s laws is an independent institution and cannot be subjected to the direction of individuals and groups of people outside the bank’s remit.

This paper has learnt that aside the review, the Economic and Organised Crime Organisation (EOCO) has been on this beat and the same issue is also said to have landed in court. Should things play out as envisaged by some analysts, the already impoverished economy will be forced to cough amounts close to half a billion dollars as compensation in judgement debt claims and that will be awful for the country and the government.

Perhaps a recap of the Bankswitch episode will be useful here. Bankswitch had filed before the Permanent Court of Arbitration, in The Hague, the Netherlands for the payment of GH¢853 million in damages for the cancellation of a contract signed with the Government of Ghana in 2007 for the management of a platform for the revenue mobilisation programme of the Customs Division of the Ghana Revenue Authority (GRA).

The contract, according to the Attorney General and Minister of Justice, Mrs Marieta Brew Appiah-Oppong was signed at a time, the State already had a contract with GCNET and a number of Destination Inspection Companies (DICs) performing the same functions for which Bankswitch was being contracted to perform.

The award by the Court, following the arguments by the Attorney General, is a reduction of about GH¢600 million from claims filed by Bankswitch.

The Attorney General told the Daily Graphic that despite the signing of the contract in 2007, the company had not started operations until 2009, following which the contract was terminated because of the existence of the GCNET platform and DICs with which government still had a contract.

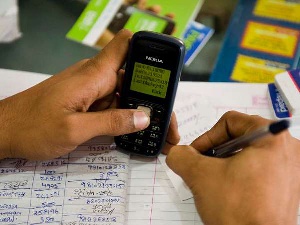

In the latest ongoing drama, a contract for the setting up of a switch for mobile money services interoperability was openly advertised, more than one entities applied and one won, Sibton Switch Systems.

Two failed bidders raised concerns after the central bank awarded the contract to Sibton Switch, citing bidding cost differences and procedures as their reasons. Bidders were supposed to use their own funds to construct the switch and operate over a period of time in order to generate revenue to cover their investments. These are all agreed to and the JUST WHEN THE Switch is almost ready, the usual business-political gymnastics begins.

The contract for a third party to interoperate the electronic retail payment system was awarded to Sibton Switch who are offering to execute the works using a self-financing mechanism to raise GHC4.6 billion on their own to build a robust interface intended to ensure efficiency in revenue mobilisation among numerous other benefits.

The two other companies that lost out of the bid were Vals Intel and Mericom Services Ltd. The two quoted GHC 14m and GHC 4m respectively while the winning firm, Sibton opted to undertake the project raising GHC 4.6billion for it.

Vals Intel, one of the two companies has conceded that it misunderstood portions of the bidding process as a result of which they might have lost the contract.

Executive Chairman of the company, Mr Kojo Graham told JOY FM that their misunderstanding of the process resulted in the company stating in their bid documents that they will prepare bill for the BOG to pay after the period they planned to operate the switch.

This paper can confirm that chief among the various options being pushed for by the failed bidders is for the BOG to cancel the already signed contract, an action that could have serious legal and financial consequences on government.

For instance, since the contract was awarded last year, Sibton Switch has been working assiduously to put up the switch as per the specifications and guidelines of the BOG. Investigations by this paper reveals that several engineering works and installations, making up the construction of the hardware and software infrastructure are almost ready for the commencement of the contract’s execution this month.

Following the media enquiries over the contract, insider information has it that experts have suggest a number of options including a process to verify whether or not the winning bid did so genuinely and whether it has the technical and financial capabilities to fulfil the contract’s mandate.

But that suggestion seems to have been ignored by certain individual officials at the Bank of Ghana who are believed to be manipulated by the losing firms.

Over the last two decades, the recklessness of state officials has resulted in government being compelled to pay judgements debts, incurred under questionable actions. The situation took political undertone with the current NPP administration promising to avoid Judgement debt payments.

In his maiden State of the Nation Address, President Akufo-Addo promised to respect and protect the sanctity of all contracts, including those singed under his predecessor as a way of avoiding frivolous judgement debts. On countless occasions, the Vice President had also assured of a new way of doing things where the private sector and the international private sector regime are facilitated by government to succeed to among other thing, enable them expand, grow and generate opportunities for employment, investments, because in their own words, “the private sector is the engine of growth”.

Ghana needs money, it needs investment and not losing both. The contract is clear on what actions to take by the parties to it and the consequences can be dire. We must do everything to resist this temptation of causing an unnecessary judgement debt.

Interestingly, this paper can confirm that the Bankswitch Judgement Debt is yet to be paid but frantic efforts are underway to cause a similar debt. One of the things for which former President Mahama was tagged by the opposition was that many of the Judgement Debts were either incurred or paid when he was Vice President and incharge of the Economic Management Team. Today, as faith will have it another Northerner is Vice President and incharge of the Economic Management Team.

Questions is will he take a prudent decision favourable to the state in this matter or he will allow himself to be influenced by be failed bidders and groupings such as the Ghana Chamber of Telecommunication whose duty it is to protect private operators in the industry but depending on when it suits its leadership, it decides to be a mouthpiece against a private sector operation involving the telecommunication sector.

Business News of Monday, 27 March 2017

Source: Jerry Tsatro Mordy