• The Private Sector Federation has expressed excitement over the new policy rate by the Bank of Ghana stating that it will help in the growth of the economy

• It says it is in the right direction since it will help in finding the balance on the policy rate influence on the lending rate of the banking institutions

• It noted that the rate should have a correlating effect on the bank rate or levy rate

The Private Sector Federation has welcomed the reduction of the policy rate by the Monetary Policy Committee of the Bank of Ghana.

It says it anticipates an immediate impact on lending to businesses.

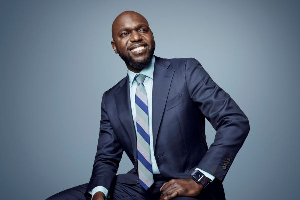

In an interview with Joy Business monitored by GhanaWeb, the president of the Private Enterprises Federation, Nana Osei Bonsu, said more can be done in easing the cost of credit.

“It is in the right direction because the policy rate is supposed to dictate the lending rate by the various lending institutions but the policy rate has some skewed elements in it that are not supposed to be there…there is a formula that determines the policy rate and that formula has cash involved glorifying a bank and if someone deposits, they [bank] don’t know what to do so they put the deposits in the vault and end up ‘glorifying’ the customer with charges…that should not happen.”

He continued that: “We also have adequate capital, these are things that the Bank of Ghana should note in the formula because if we look at the policy rate, which should have a correlating effect on the bank rate or levy rate, it is not doing that so you have a margin of almost about four to five hundred basis points from the lending rate to the policy rate. So we think that yes, it is in the right direction but the real culprit that we have to work with is how to find the balance on the policy rate influenced on the lending rate of the banking institutions.”

Speaking on their expectations of the new policy rate, Nana Osei Bonsu said his outfit is pleased because the reduction will have a positive impact on their businesses.

“We are not jumping up and down in excitement but it is in the right direction and that adds up to the decision-making process which is very critical. So the policy rate is in the right direction and it is being reduced and we hope to see a further reduction where the policy rate would influence the lending rate directly, [because] there is a direct correlation between the two,” he added.

The Bank of Ghana slashed its policy rate by a 1% point from 14.5% to 13.5%.

Announcing the decision at its 100th MPC press conference, Governor of the Bank of Dr Ernest Addison on May 31 said this was based on risks to the country's inflation outlook remaining muted in the near term.

Business News of Wednesday, 2 June 2021

Source: www.ghanaweb.com

Private enterprise federation upbeat about immediate impact of lending

Entertainment