Panelists at the 2016 Budget Forum have underscored the need for prudent management of oil and petroleum revenues to ensure sustainable development for the country.

The panelists expressed the need for fiscal discipline, accountability and transparency in the use of oil revenues in order to make the most out of oil revenues to promote sustainable development.

The Forum organised by the Natural Resources Governance Institute (NRGI) and IFS was on theme: “Making the Most of Petroleum Revenues.”

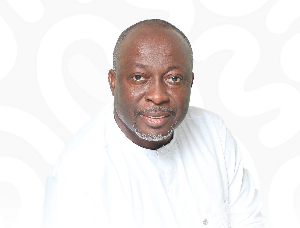

Speaking at the Forum Mr Alex Ashiagbor, Chairman of the Institute for Fiscal Studies Governing Council Chairman, said the abundance of natural resources in a country should be a blessing for creating jobs, export earnings, and public infrastructure, among others.

Mr Ashiagbor said mismanagement of natural resource proceeds could lead to volatility in government revenues, price and exchange rate fluctuations, and a destabilising impact on the balance of payments.

He explained that in order to effectively manage risks associated with natural resource exploitation and management, the country needs strong institutional framework that would address institutional weaknesses such as corruption, non-adherence to the rule of law, weak governance and political interference and instability.

He noted that the focus of managing oil revenues sovereign wealth funds, such as the stabilisation fund should not only be for short term purposes like budget support but for long-term investments into accumulation capital, both human and non-human.

He said proper investment and production policies would help the state and investors to ensure equity in the payment of taxes and royalties, adding: “It must be a win-win situation.

“Efficiency, transparency and accountability are crucial for the management of revenue from extraction of natural resource.”

Mr Ashiagbor also called for severe sanctions for extractive companies who flout laws and incentives given to those who do the right thing.

Mr Mark Evans, Africa Economic Analyst – NGRI, said although the Petroleum Revenue Management Act (Act 815) sought to among others things, use petroleum revenues to mobilise financing or development priorities, it had not led to better budget outcomes.

He said it wiould offer few tangible benefits in the absence of commitment to careful management of the broader budget.

“Ghana has seen petroleum revenue savings overshadowed much larger increases in debt since 2011,” he said, adding that there remain gaps in transparency in the PRMA with regard to the calculations of the saving rule in the law.

“The PRMA’s rule will lack credibility in the absence of rules, commitments and reform efforts that place limits on overall expenditure growth, the size of the deficit, and realign spending patterns to development priorities.”

Business News of Sunday, 8 November 2015

Source: GNA

Petroleum revenues need prudent management - Forum

Entertainment