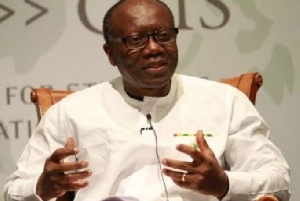

Finance Minister, Mr Ken Ofori-Atta has said the country’s pensions industry strongly hinges on the regulatory measures put in place by the inaugurated National Pensions and Regulatory Authority (NPRA) board.

He said the board must act quickly to stem the practice where Trustees and Administrators undermine the role of the Fund Managers as well as micro-manage the investment process.

Ofori-Atta said the risk to the system of having a Trustee or Administrator ‘’dominance’’ will be severe as pensions are about social security and retirement income protection.

‘’This practice is not of international standard and will derail efforts made to use the pension industry to transform the economy,’’ Ofori-Atta warned.

Since 2012, Ghana’s private pension funds have grown from GHS0.81 billion to GHS11 billion at the end of 2017, while that of the Social Security and National Insurance Trust (SSNIT) have stood at GHS9 billion for the period.

On the informal sector’s pension, Ofori-Atta said the NPRA board is expected to lead efforts in establishing an informal sector pensions schemes with a focus on cocoa farmers.

‘’While the Chief Executive Officer of the NPRA has done the preparatory work, an implementation team must be set up to facilitate the establishment of the scheme in the second half of 2018,’’ he added.

Ghana’s informal sector is the largest work force which employs about 80-85 percent of workers. However, there is low enrolment in the formal pension scheme with many informal workers living below the poverty line in their old age.

To address this, the minister said the introduction of the 3-Tier Pension Schemes established by the National Pensions Act, 2008 as amended, has made a provision for a pension scheme arrangement for workers in the informal sector.

‘’The expectation is that the set-up of the informal sector scheme will be based on an extensive use of the mobile money platform and other electronic-payment systems to provide easy access especially to those outside the major cities.

This mode of payment will be supported by the new Payment Systems and Service bill, which is before cabinet,’’ he added.

He said, in all these, guidelines will have to be reviewed in order to help achieve policy initiatives of government and particularly the pensions sector, with a need for legislative instruments for the informal sector pension schemes.

The Finance Minister urged the NPRA Board to work assiduously with other regulators to improve pension coverage in Ghana.

Business News of Monday, 9 July 2018

Source: goldstreetbusiness.com