The 275-member legislature are seemingly aghast at the country’s tax exemption regime, joining a queue of advocates who have expressed concern about the increasing rate of tax exemptions which they claim are “damaging the country economically and costing government in revenue”.

This year, government has estimated that the value of import tax exemptions could reach GH¢2billion, creating a worrying situation for taxmen, policy analysts and the country’s non-concessional lenders.

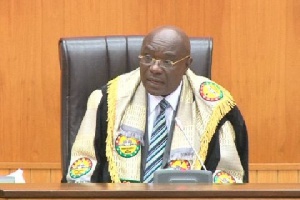

Last week, the lawmakers dispassionately discussed on the floor of the house the need to review the country’s tax exemption regime, and even got the Speaker of Parliament, Edward Doe Adjaho to comment: “This has been a recurring matter and I think it’s time we look at it”.

The issue cropped up when chairman of the Finance Committee James Avedzie prayed the House to adopt the Finance Committee report on the request for waiver of import duty, import VAT, import NHIL, ECOWAS levy, EDAIF and other project-related imposts amounting to US$40,171,308.

These consist of materials, equipment and services to be imported and/or procured locally under the agreement between government of Ghana and Credit Suisse International for the construction of 5,000 Affordable Housing Units by construction OAS for the general public.

However, various members of both the majority and minority were unhappy about the consistent request for tax waivers.

Dr. Matthew Opoku Prempeh, MP for Manhyia South said: “It is ridiculous, the tax exemptions are too much”.

His concern was equally shared by majority Chief Whip Mohammed Muntaka, who maintained that the US$40million tax exemptions are on the high side.

Ranking member on Finance Dr. Anthony Akoto Osei insisted that: “It is costing government a lot of money; we should review it carefully. Government is supposed to come up with a policy on changing the tax exemptions; they have been talking about it, so it is about time they bring it so we help the government to improve upon it,” he said.

Paapa Owusu Ankomah in similar fashion indicated that he had expected the policy on tax exemption should have been finalised by now, and was surprised it has not materialised or come before Parliament.

Majority leader Alban Bagbin assured the house that “it is a matter in the right direction, and leadership will take it up and discuss it with government”.

The International Monetary Fund (IMF), which is overseeing the implementation of a three-year Extended Credit Facility Programme for Ghana, has also raised questions about the country’s tax exemption regime and asked government to overhaul it.

Professor Newman Kusi of the Institute of Fiscal Studies, in a paper published in the B&FT, recently also asked government to fix loopholes in the country’s revenue system arising from exemptions, under-invoicing, bonded-warehouse facility, transit goods, and export processing zones to enhance domestic revenue mobilisation.

The Chief Tax Policy Analyst of the Ministry of Finance, Larbi Siaw, in recent times has also raised concerns about the tax exemption regime -- which some Ghana Revenue Authority officials have cited as one of the biggest challenges to meeting revenue mobilisation targets.

Tax exemptions, which have so far this year cost the country GH¢1.6billion as at September, have been used by many developing economies as bait for increased Foreign Direct Investment (FDI).

But some businessmen and corporate bodies have challenged the effectiveness of tax exemptions policies to attract FDIs, and want Ghana’s legislature to take concrete steps to review it.

A research on Tax Justice by Action Aid Ghana (AAG) for example indicates the popular assertion that tax incentives attract FDI is not true, and that other factors including skill-pool availability and social infrastructure services -- such as good schools, good road networks, health facilities, and electricity -- are significant considerations for multinational companies when it comes to taking decisions on investment.

The study estimated that the negative impacts of corporate tax incentives include giving undue advantages to big firms and multinationals at the expense of smaller and domestic industries.

It said the development also promotes corruption by enabling special treatment to be given to specific companies.

The report said West African countries are losing an estimated US$9.6billion of revenue each year by granting tax incentives to foreign companies.

Three countries, the report claim -- Ghana, Nigeria and Senegal -- are losing an estimated US$5.8billion a year through the granting of corporate tax incentives.

It stated that Ghana loses around US $2.27billion, Nigeria around US$2.9billion, and Senegal up to US$638.7million.

Business News of Monday, 7 December 2015

Source: B&FT

Parliament raises red-flag over tax exemptions

Entertainment