Opportunity International, a Savings and Loans Company has opened a new branch at Tamale to cater for customers in the Northern Region.

The new branch which is a step to fulfill the company’s promise to extend its services to the northern Part of Ghana adds up to the existing 45 branch network of the financial institution.

Mr Kwame Owusu-Boateng, Chief Executive Officer (CEO) said the branch would create employment for qualified personnel to add up to the existing 782 dedicated workforce of Opportunity International.

Speaking at the ceremony, he said the company is committed to support small and medium scale enterprises which are integral part of the Ghanaian economy.

“The focus of our business has been on sectors of the economy that is dominated by small and medium sized enterprises that are mostly in need of very small loan amounts for injection into their businesses.

“Evidence from our transformational impact has shown that our loans have had significant impact on the lives, families and communities of our clients”, he said.

The CEO noted that the company from such small beginnings is able to grow their clients and support them right through the process to the top, where they become significant players in their industry and communities.

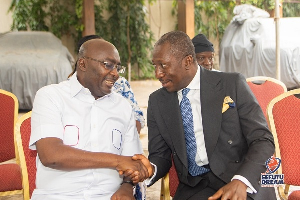

Mr Abdul Hanan Gundadow, Tamale Metropolitan Chief Executive, commended Opportunity International for being a dependable partner to small and medium scale enterprises.

He entreated the company to serve the Tamale community and help transform the lives of market women in the metropolis.

“As you enter the Tamale market, we expect that you will serve our community with your life changing products and services so that we shall transform the lives of our market women and other micro clients”.

Mr J.T Kudah, Regional Manager of Bank of Ghana advised customers to pay back when they borrow from financial institutions to enable the institutions render the best of support to businesses in the Ghanaian locality.

He said failure to repay credit facilities prevents other customers from accessing funds to support viable economic initiatives while limiting the viability of the institutions’ operations

Mr Kudah also cautioned the public to be mindful of unauthorised financial institutions acting in the name of microfinance and investment.

With the introduction of a range of electronic products and services including funds transfer, airtime top-up, and balance enquiry, Opportunity International has increased its loan portfolio to GH¢ 88.4 million with total deposit clients of more than 425,000 as at June.

The company has deposit balance of GH¢ 85.5 million.

Voted “Non-Bank Financial Institution of the Year, 2013” by the Chartered Institute of Marketing, Ghana, Management of Opportunity International Savings and Loans Limited envisions reaching one million clients by 2020.

Business News of Wednesday, 2 September 2015

Source: GNA

Opportunity Int’l inaugurates Tamale Branch

Opinions