Workers of the three main revenue agencies integrated under the Ghana Revenue Authority (GRA) who were apprehensive about a possible retrenchment can now heave a sigh of relief as their jobs are secure.

Concerns have been raised by some staff of the revenue agencies as a result of the reform of the country’s revenue system as stipulated by the Ghana Revenue Authority Act which was passed in December 2009.

Many thought the integration and modernization of the revenue system which brought together all three main revenue agencies namely Customs Excise and Preventive Service (CEPS), Internal Revenue Services (IRS) and the Value Added Tax Service (VAT) under one umbrella would lead to a reduction in the staff strength of the various agencies.

However, Nii Ayi Aryeetey, Deputy Commissioner in charge of Policy Programmes at the Domestic Tax Revenue Division of the Ghana Revenue Authority (GRA) told CITY & BUSINESS GUIDE in Accra that all workers had been given letters approved by the board confirming their employment.

Though the transition is on-going, Mr Aryeetey stated that “there are no plans to lay off workers. In fact there is more than enough work.”

The Deputy Commissioner explained that workers are being reassigned to specific roles “and the reallocation of staff to fit into the overall integration.”

“Of course there is the anxiety but there is some reassignment of roles and no body would be laid off.”

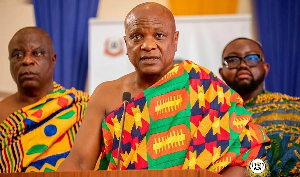

George Blankson, Commissioner General of the Ghana Revenue Authority (GRA), on his part, noted that the integration and modernization of the revenue system had improved the system as it involved redesigning of the business processes and procedure, intensification and expansion of the use of Information Technology (IT) to improve service delivery.

“The reform has chalked important milestone as we are able to constructively engage all stakeholders in a manner that will yield sustainable results and confidence in the country’s tax system.”

As a result of the integration, the various divisions now have a joint audit as well as share information about taxpayers’ liability to different taxes as against the former system whereby taxpayers reported different figures for different tax types.

The commissioner, who attributed the overwhelming performance of GRA last year to the synergies from the reform, praised taxpayers for honouring their tax obligations.

In 2011 though the Authority planned to collect GH¢7,544.66 million by the end of December it declared a provisional amount of GH¢8,706.39 million, exceeding the target by GH¢1161.73 million.

“This is a remarkable achievement,” said Mr Blankson.

For this year the GRA has been tasked to collect GH¢11.166.57 million for the state treasury, representing a 28 per cent increase over the figure for the previous year.

Business News of Thursday, 19 January 2012

Source: Daily Guide

No Lay Offs At Revenue Authority

Entertainment