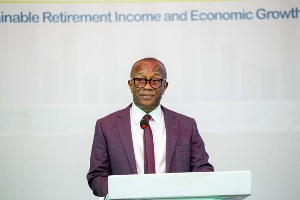

The Chief Executive Officer of the National Pensions Regulatory Authority (NPRA) of Ghana, Chris Boadi-Mensah, has been officially elected to serve on the Executive Committee of the International Organisation of Pension Supervisors (IOPS) for the 2026–2027 term.

The announcement was made at the Annual General Meeting of the OECD/IOPS held during the Global Forum on Private Pensions in Istanbul, Türkiye, from 5–7 November 2025.

NPRA’s elevation to this high-level decision-making body is a significant acknowledgement of Ghana’s steady progress in strengthening pension supervision and regulatory effectiveness.

The IOPS Executive Committee, comprising a minimum of five and a maximum of fifteen members representing at least three continents, has full responsibility for steering the Organisation’s strategic objectives and promoting strong supervisory standards for private pension systems internationally.

Its mandate includes appointing Chairpersons and Vice-Chairpersons, reviewing membership applications, overseeing the Secretariat, and setting the agenda for the Annual General Meeting and international conferences.

Already an active contributor to the IOPS Technical Committee, NPRA’s new role positions Ghana at the centre of global pension governance.

The Authority will serve a two-year term, with the possibility of re-election.

Other countries represented on the Governing Board for the upcoming term include Egypt, Hong Kong (China), Namibia and Romania.

Ghana’s delegation to the Forum was led by the Deputy Chief Executive Officer of NPRA, Victor Azuma Mejida, who participated in a panel discussion on “The Role of Pension Funds in Strengthening Capital Markets.”

The session explored how pension funds can support domestic financial markets, enhance capital mobilisation, and contribute to long-term economic stability.

New NPRA Board inaugurated to strengthen pension oversight

The broader Forum discussions covered a spectrum of emerging trends and strategic issues within global pension systems.

These included digitalisation in pension administration, asset-backed pension reforms, supervision of payout phase design, implementation of life-cycle investment strategies, expansion of voluntary pension participation, and the growing role of pension funds as major institutional investors.

NPRA’s inclusion on the Executive Committee places Ghana in an influential position to shape international pension discourse while benefiting from global best practices.

The insights gathered from the Forum are expected to inform both near-term regulatory priorities and long-term policy reforms, helping to strengthen the resilience, innovation, and sustainability of Ghana’s pension sector.

SP/EB

All you need to know about Ghana's new vehicle number plates |BizTech:

Business News of Monday, 8 December 2025

Source: www.ghanaweb.com

NPRA secures seat on Global Pension Supervisors Executive Committee

Opinions