Mr Samuel Sarpong, the Managing Director (MD) of the National Investment Bank (NIB) has assured Small and Medium-sized Enterprises (SMEs) of the bank’s continuous support to help grow and sustain their businesses.

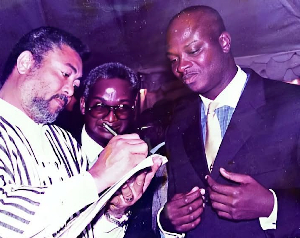

A statement from the Bank to the Ghana News Agency said he gave the assurance when he led a five-member team from the Head Office to visit some shops at Okaishie and Accra CMB Markets within the Central Business District.

It explained that Mr Sarpong, after his recent appointment had initiated a range of programmes aimed at restructuring the bank as part of measures to re-position it for growth.

According to the statement, the MD believed direct interaction with individual customers and business operators would give management a deeper understanding of their specific needs, thereby, tailor-make products to address their needs.

“SMEs in particular have over the years lamented the challenges associated with accessing credit from commercial banks in the country, a phenomenon that makes it difficult for most SMEs to survive their first five years,” he said.

The statement said NIB was expected to become one of the strongest banks in the country following government’s assurance to recapitalize it on the heels of a Bank of Ghana requirement for all commercial banks in the country to have a minimum capital of 400 million Cedis.

A revitalized NIB according to Mr Samuel Sarpong would support the nation’s industrialization agenda by making funds easily accessible to especially the manufacturing sectors of the economy, it added.

The statement quoted Mr Sarpong as saying: “NIB is going to be more responsive to the needs of businesses than it has ever been. This includes the deployment of smart banking solutions and products that would meet the specific needs of all our customers.”

It said he encouraged business owners to adopt practices and strategies such as proper record-keeping, prompt debt payments, and regular savings to engender confidence among business partners and financial institutions, thereby, making it easy for them to access funds.

Mr Samuel Sarpong, the statement said was accompanied on the tour by Mr George Alfred Thompson, the Deputy Managing Director of the Accra Main Branch of the bank, Mr George Addae-Mensah, the Manager, Madam Aba Katu, the Excel Banking Manager and Mr Selorm Kudzo Amey of Customer Services Unit of Newlife.

Business News of Sunday, 14 July 2019

Source: ghananewsagency.org