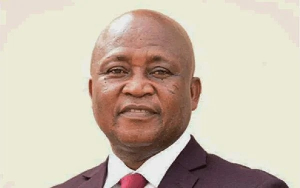

Mr Emmanuel Budu-Addo, Head of Finance at ActionAid Ghana, a social justice advocacy non-governmental organization, has entreated Government to monitor and capture all multi-national companies operating in the country onto the tax net, to increase revenue for infrastructural development.

He said many multi-national companies were diverting huge profits and invading taxes through dubious financial practices, which undermine government’s fiscal policies with detrimental effects to the citizenry.

He said Ghana losses not less than GH¢ 1.2 million annually through tax invasion, and stressed the importance of vigilance in tax collection.

Mr Budu-Addo, who was addressing a two-day sensitization workshop in Tamale on Monday on tax justice said all companies in the country must be made to pay realistic taxes to generate the needed funding for the implementation of government policies.

The workshop was aimed at deepening the understanding of participants on tax justice and illicit financial inflows with the overall goal of forming a regional coalition to advocate against tax invasion.

Mr Budu-Addo indicated that there are so many loopholes with weak legal and policy systems in the country, which enables such companies to flout the rules with impunity, noting that the country would not have been plunged into financial difficulties if there were proper management and ways of capturing everybody onto the tax net.

He said Ghana has been recording deficit with foreign direct investments, despite generous incentives, saying, “Ghana seems to have the lowest tax rate compared to Nigeria, yet Nigeria receives more than double of foreign direct investment than Ghana."

He observed that corporate taxes were fast reducing, but that of individual taxes had been increasing dramatically, and advised the Government to put pragmatic measures in place to reverse the trend.

“Between 2008 and 2013, tax revenue loss from trade was about 49.73 percent equivalent to $ 234 million…revenue lost for only two companies’ takeovers was $ 67 million in the oil industry," he said.

Madam Queronica Quartey, ActionAid Ghana Policy and Campaigns Manager, said tax justice has become very topical in the country, giving the fact that the National Economic Forum at Senchi recently delved much into tax justice and invasion.

According to her, donor countries were not happy about the manner in which funding being given to state institutions and governments were disproportionately utilized without positive results, stressing that the scenario of “The more you pay, the more you get” has dominated the tax industry.

She showed that AAG has taken upon itself to build the capacities of the citizenry, to form platforms for social mobilization to ensure that people and institutions pay taxes justifiably.

Madam Quartey urged African governments to ensure that multi-national companies pay realistic taxes to enable Governments derive the needed revenue to implement social infrastructure such as schools and hospitals for the development of their countries.

Madam Esther Boateng, Northern Regional Programmes Manager of ActionAid Ghana observed that the tax justice was a very technical topic, and urged the public to develop interest in it so as to salvage the ailing economy.

Business News of Wednesday, 11 June 2014

Source: GNA

‘Multi-nationals must be checked to increase revenue’

Entertainment