Savings and loans companies are asking the government to reconsider the now-postponed but imminent Value Added Tax (VAT) on financial services.

The second-tier financial institutions believe that VAT on financial services will derail government’s efforts to expand access to financial services nationwide.

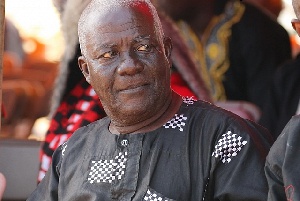

“The provision of financial services comes at a cost, a significant operational cost, and some of those costs are invariably passed on to the customer. So to have VAT, which is an indirect tax, slapped on the provision of these services will further increase the cost of doing business -- not only for the industry but also for the ordinary man on the street,” said Vice President of the Ghana Association of Savings and Loans Companies (GHASALC) Theodore Kwaku Albright.

“If we want to the vast majority of people to enjoy financial services, then perhaps the government ought to take another look at the tax, which is going to be levied on the client,” he added.

Around 70 percent of Ghanaian adults are unbanked, and cost is one of the main barriers to accessing financial services a World Bank survey found.

Mr. Albright explained that, already, clients of savings and loans as well as microfinance companies look at the financial sector with some degree of scepticism and suspicion due to the activities of some unscrupulous players in the industry.

“So to slap on an additional charge further heightens the suspicion, scepticism and cynicism that clients have in respect to bringing their money to the deposit-taking financial institutions.”

Speaking at a one-day workshop to educate members of GHASALC on the implementation of the VAT on financial services, Mr. Albright added that any economy that seeks to grow rapidly will have to bolster small and medium enterprises.

“The economy is bolstered by encouraging small and micro entrepreneurs to partake in economic activities. What small and micro companies do not need is additional cost when partaking in these economic activities which will lead to growth. If you want to encourage a particular sector of the economy, then you can’t do worse than putting a levy on the very service that you want to encourage.”

Head of Finance at Union Savings and Loans, Kwasi Nimako, said even though it is an opportunity for government to generate revenue, the tax is not strategic enough because it doesn’t support financial inclusion.

“The opinion of the people is that they will be paying tax if they use financial services. Meanwhile, the income that banks and other financial institutions make from fees is about 30-40 percent; the greatest portion comes from interest income.

“Also, the range of services offered for a fee cuts across individuals and corporates. So this tax might be useful if it is targetted at corporates only, because they have the opportunity to recoup VAT if it becomes input tax to them. But individuals don’t have that opportunity, so for them it is additional cost and discourages them from using financial services,” he said.

Chief Revenue Officer at the Ghana Revenue Authority (GRA) Kwesi Ackaah explained that suspension of the implementation is to allow all stakeholders involved to receive better education on the subject.

“We want them to understand it properly so that implementation will go smoothly and they can also put their systems together. This tax is on financial service, so if you go to the bank then you will be affected. The fact of the case is that if a person can go to a bank to engage in its services, then that person has the capacity to pay.

“Let’s also understand that government needs to raise revenue, and government looks for avenues. Initially, it may not sound well to the people; but as time goes on and the people are well informed and educated, they will understand.”

Business News of Friday, 4 July 2014

Source: B&FT