The Monetary Policy Committee (MPC) on Friday announced a one percentage point increase in the policy rate to 14.5 per cent from 13.5 per cent, citing the upside risks to inflation.

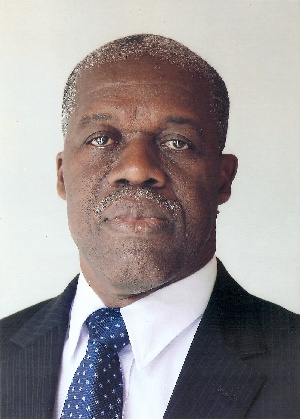

Mr Kwesi Amissah-Arthur, Governor of Bank of Ghana (BOG), said at a press conference in Accra that although growth potentials remained strong, prevailing exchange rate developments could act to offset the gains made in macroeconomic stability.

“Given the current macroeconomic conditions, the assessment of the Committee over the forecast horizon shows an elevated inflation profile,” he said; necessitating the need to increase the policy rate.

“The Committee was of the view that the upside risks to inflation outweigh the downside risks to growth and therefore decided to increase the policy rate by 100 basis points to 14.5 per cent,” Mr Amissah-Arthur said.

He said the BOG was also reducing the single currency Net Open Position (NOP) of banks from 15 per cent to 10 per cent and the aggregate NOP from 30 per cent to 20 per cent in a move intended to improve the supply of foreign exchange by banks to the market.

He said recent developments in the exchange rate and its possible impact on inflation as well as implication for the country’s international reserves called for decisive policy measures to stem the trend.

The cedi continued to weaken against the dollar in the foreign exchange market as a result of high demand, leading to a depreciation of 8.3 per cent against the dollar in the first quarter of the year compared to two per cent in the same period of 2011.

Mr Amissah-Arthur said the cedi had fallen due to a number of factors, including growing demand for foreign exchange to support increased economic activity due to the expansion of the economy, the changing nature of trade pattern, which was shifting towards Asia, especially China in which transactions were mostly conducted on cash basis as well as speculative activity by foreign exchange traders trying to profit from the depreciation of the currency.

The Governor said, policy intervention would therefore aim at minimising the risks to inflation and growth by stemming the depreciation of the cedi in order to build reserves to levels that would be able to withstand external shocks.

“In doing this, we plan mainly to use the market mechanism to reverse the liquidity overhang. But we will also strengthen controls to reverse the process of dollarisation in the economy,” he said, adding that the Bank was closely monitoring developments and would not hesitate to take additional measures if deemed necessary.**

Business News of Friday, 13 April 2012

Source: GNA