The Chamber of Mines has expressed worry about the perennial delay in Value Added Tax (VAT) refund due the mining industry -- valued at GH¢250million as at the end of June 2014.

The amount yet to be refunded by the Ghana Revenue Authority is having adverse effects on cash flows for mining companies in the country, particularly in the face of a dip in price of commodity on the global market.

Government has on several occasions expressed its intention to implement legislation that will ensure VAT refund compliance. The demand for the promulgation of a law as a condition for the formal implementation of the policy is a serious disincentive to mining firms.

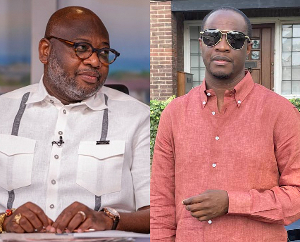

The President of the Ghana Chamber of Mines, Mr. Johan Ferreira who expressed these sentiments in Accra said: “It is the industry’s expectation that government will expedite action on the measures to permanently redress the perennial delay in the refund.

“The situation is not healthy for private enterprise and only compounds the escalating cost of doing business in the country.”

Commenting on the special petroleum tax, he said -- relative to the generic consumer -- the mining industry pays a premium for the consumption of diesel, from which the resulting windfall is used in subsidising social fuel such as the pre-mix that is consumed by low-income households.

“In addition to this incipient tax, the government’s 2015 budget statement and economic policy announced the introduction of a 17 percent tax on petroleum products under the special petroleum tax Act, 2014 (ACT 879).

“This widened the price differential for the products between the mines and generic consumers from 12 percent to 19 percent.”

He added: “Given the high volume of diesel consumed by the industry, the increase hiked the operating costof mining companies deeply and instantaneously. For instance, one member-company’s annual expenditure on fuel increased by about US$100,000 on the back of the increase.”

Mr. Ferreira explained that the deficit in supply of electricity has compelled most companies to rely on diesel-powered generators to augment their load demands, further exacerbating the cost pressure on the industry.

Estimates from the Chamber suggest that the increase in expenditure on fuel as a result of the special petroleum tax will drive the all-in-cost of typical mine up by US$17 per ounce.

The Chamber therefore suggest that the government should relieve the mining sector from payment of special petroleum tax, and not only on account of its significant contribution to the growth of the Ghanaian economy but also due to the premium it has paid on diesel.

Mr. Frederick Attakumah, the 1st Vice President of the Chamber and Managing Director of AngloGold Ashanti Ghana Limited, confirmed that the industry has had to contend over the period the sustained headwinds of depressed metal prices, high input cost and energy security challenges.

“Our industry and its stakeholders are presented with a unique opportunity to innovatively position mining as a critical agent for catalysing broad-based sustainable growth and socio-economic development.

“This will require recognition of the important role the sector plays in the Ghanaian economy, and a broader understanding of its beneficial multiplier effect across the socio-economic spectrum of our country.

“We need to look beyond the traditional contribution of fiscal flows, foreign exchange generation, job-creation and technology acquisition to the broader opportunity of strategically leveraging the sector a lot more for small and medium enterprise development by taking advantage of upstream, downstream, and direct value chain opportunities that the mining industry presents.”

Thus, he said, the industry players must ensure benefits created by the sector are sustainable through active support for local procurement initiatives, integration of local communities and businesses into the supply chains, catalysing diversification, and pragmatic resource management.

“It is our ardent belief that given the context set and supported by a robust policy framework, mining can take centre-stage in the development of skills, expertise and revenues necessary to catalyze national development.

“The Chamber will continue to leverage our industry as a critical growth pole for national socio-economic development. This will be further strengthened by our members’ exciting interventions and strategic objectives,” Mr. Attakumah remarked.

Business News of Thursday, 18 June 2015

Source: B&FT