Mobile financial services company, MTN Mobile Money Limited has announced the introduction of an additional security feature that allows its mobile money agents to verify the identity of customers who come to do ‘cash out’ transactions.

This added feature comes on the back of an earlier decision requiring agents to demand valid ID cards before undertaking cash out transactions for customers.

The new feature, expected to commence today is christened a ‘second layer validation’ and comes in handy to perform the simple function of enabling MoMo agents to have access to the bio data of the person withdrawing funds from their mobile wallets and compare it with the details on the ID card before carrying out the transaction.

Previously, agents were unable to access the details of persons who come in to withdraw money from their wallets.

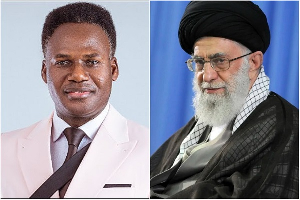

Speaking at a media interaction on its earlier directive to mobile money agents on ID requirement, CEO of MTN Mobile Money Limited, Eli Hini, said that the second layer validation process is a security feature that gives additional information to agents to verify the true identity of the person doing the transaction.

“With the introduction of the new ID Card requirement initiative, feedbacks were picked and a major concern was real time validation of customer information before a transaction is carried out which is difficult and looks impossible because transaction time is limited and may lead to failure or time-out severally, therefore, customers could not even carry out their transactions at all.

Even if we want to carry out a real-time validation process, then it will mean that only the specific ID used to register the sim will be accepted, therefore people with new IDs or different form of nationally accepted IDs will have their transactions terminated for data mismatch.

But with what we have done, validation is processed based on data captured against the IDs that are accessible from our end,” he said.

He further stated that with this new system, MoMo agents have no excuse of saying we only captured data we cannot verify because the data of the person doing the withdrawal on the MTN system will be given to them, — then they compare it to that of the person standing in front of them.

“If you are performing a transaction, the name on the ID card must tally with the one on the system, it cannot be anyone else. So, you cannot proceed when the names do not tally, the agent must immediately discontinue with the process and advise the person because he may be a fraudster.

Agents who default on this directive maybe cautioned on the first instance but when repeated maybe blacklisted, he added.

Business News of Wednesday, 14 April 2021

Source: business24.com.gh