Business News of Friday, 24 July 2020

Source: GNA

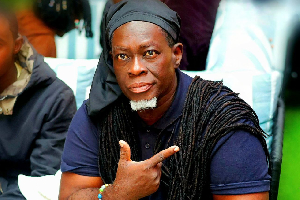

MPR cut down as inflation decreases - Ofori-Atta

Mr Ken Ofori Atta, Minister of Finance has said the Monetary Policy Rate (MPR) was cut by 100 base points in 2019 as inflation declined and inflation expectations eased in a mid-year budget review presented to Parliament on Thursday.

In line with this, the interbank weighted average rate (IWAR) decreased to 15.2 percent in December 2019 from 16.1 percent in December 2018. The reduction in the IWAR was as a result of a reduction in BOG's participation on the overnight market to encourage trading among banks.

Mr Ofori Atta said similarly, the average lending rate marginally declined to 23.6 percent in December 2019, from 23.9 percent in December 2018.

He said the yields on Treasury Bills, however, increased marginally in 2019 and the 91-day Treasury Bill rate inched up to 14.7 percent in December 2019 compared with 14.6 percent a year earlier.

The Finance Minister said interest rates on the 182-day instrument also moved up to 15.2 percent, from 15.0 percent over the same period. In contrast, rates on the secondary bond market remained broadly stable or declined.

He said yield on the seven-year bond declined to 16.3 percent in December 2019 from 18.8 percent in December 2018. However, the yield on the 15-year bond saw a slight uptick to 20.0 percent in December 2019 from 19.5 percent in December 2018, yield on the 10-year bond also edged up slightly to 19.8 percent in 2019 from 19.5 percent in 2018.