The Ghana Stock Exchange (GSE) is proposing the listing of companies under government’s “One District One Factory” policy on its exchange via the Alternative Market (GAX).

Managing Director of the Exchange, Mr Kofi Yamoah, said “listing will put such entities into commercial orientation from day one”.

The GSE boss made the call when he hosted Government’s Nominee for the Ministry of Business Development & Investments, Alhaji Awal Ibrahim Mohammed in his office in Accra.

GSE’s GAX was created with SMEs in mind, getting lower entry requirements, negligible listing fees and listing support fund.

SMEs that do not have funds to undergo the initial listing process that is paying for ‘sponsoring fees’ are assisted with a fund created by the African Development Fund and the GSE.

Section XIII of the ruling government’s 2016 manifesto indicates that government will create small and medium factories in all districts and municipalities of the country.

Mr Yamoah also advised government to migrate from the 100 percent ownership of businesses and invite private participants to boost confidence in those firms.

“Ownership structure could include local authority, private sector strategic investors and the investing public including investors from those districts”, he added.

He stated that there should be aggressive promotion of investments both abroad and locally to attract local and foreign investors-local retail investors, local pension funds, Ghanaians in diaspora, foreign portfolio and foreign strategic investors.

“Ghanaian embassies and high commissions should be oriented towards a greater focus in attracting investments and businesses into the country.”

Explaining further, he called for the review of the National Pension Act to allow private pension funds to invest more in businesses with potential for profit and growth including SMES’.

Currently the permitted investments per Section 176 of the National Pension Act (Act 766) include notes and bonds issued by government and Bank of Ghana, notes and bonds issued and listed on GSE by corporate entities and ordinary shares of companies listed on the GSE with declared and paid dividends in the preceding five years.

Mr Yamoah also said the stock market provides the avenue, through its Ghana Fixed Income Market for entities to issue and list bonds for infrastructural projects especially revenue-generating ones. “ECG, Ghana Water, VRA, Ghana Gas and major roads and railways to be constructed can all issue long term bonds on the market against escrowed revenue streams.”

He added that listing of some public institutions will improved market liquidity, attract investors and boost non-tax revenues of up to GH¢500 million for infrastructural projects.

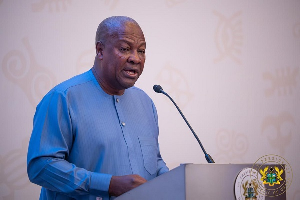

In his response, the Nominee Minister for Business Development and Investments, Alhaji Awal Ibrahim Mohammed, said his government will do its best to enhance Ghana’s business environment by implementing policies and removing bottlenecks that impede the growth of firms.

According to him, his government which is pro-business will immensely support the growth of the capital market by encouraging and giving incentives to businesses that intend listing on the Accra Bourse. “We are capitalist inclined and our vision is to churn out many private firms that will lead to massive employment creation. We are committed, ready and willing to provide support to every company in Ghana to become giant ones and probably multinational firms.

The GSE was established in 1990 and commenced trading on November 12, 1990. The exchange is governed by a council which is presently chaired by Managing Director of Standard Chartered Bank Ghana, Kweku Bedu-Addo.

Business News of Friday, 3 February 2017

Source: The Finder