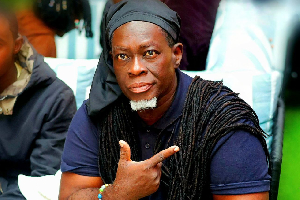

Frank Adu Jnr, Managing Director of CAL Bank, has taken a swipe at critics of the Governor of Bank of Ghana -- asking them to rather direct their vituperations to the government for the woes of the cedi.

Mr. Adu said the governor of the country’s Central Bank does not manufacture foreign currency, but the cause of the problem has been the result of years of “economic and fiscal misadventure”.

Dr. Kofi Wampah, the Governor, has received a lot of flak over the continuous slide of the cedi which has depreciated by about 27 percent against the US dollar year-to-date, earning the tag as Africa’s worst-performing currency in 2014.

A Member of Parliament for New Juabeng South, Dr. Mark Assibey-Yeboah, has called on the Governor to resign because he appears to be giving false hopes about solving the depreciation."He has done his bit, but he is not up to the task."

A private legal practitioner Dr. John Ephraim Baiden has also dragged the Central Bank to court over depreciation of the currency, asking the court to order the bank to put in measures to provide a stable currency.

While accusing the BoG of overstepping its bounds, and as a result, hurting the cedi, the plaintiff noted in his statement of case that the court should ensure that Ghanaians regain their “monetary sovereignty”.

Every day, the cedi depreciates by about 0.3percent on average -- and the relentless slide continues to hurt the economy and households, with destabilising effects on government’s fiscal plans.

In an interview with the B&FT, the seasoned banker noted that if this country chooses to import everything needed including offal -- animal waste -- which is the fifth-largest import, “then there must be something wrong with us as a people”.

He opined that with the opening-up of the economy so much in the name of trade liberalisation and creating a balance of trade deficit, one does not expect anybody to “conjure dollars from anywhere”.

“Don’t blame the Governor; blame the political managers of the economy over the past 20-30 years. If we do not change our attitude as a people and say we will support our currency and economy, and continue to import everything we need into this country including toothpicks and toothpaste, we will not get out of this mess.”

Reacting to criticism that banks are underpaying savers and overcharging borrowers, he said that banks are rather paying more for deposits now than ever before; and his bank’s deposits have gone up since February 4th, even with the introduction of the BoG regulations.

“Find out if any of the 27 banks have lost deposits as a result of any of these measures. I can tell you that CAL Bank has not.”

He said this is not the first time the currency is falling. “In 2003, the dollar went from ¢3,000 in January to ¢6,000 in December, effectively or theoretically the cedi disappeared. So this is not new, we are just not being smart as a people governing our own country. We are being lazy and we prefer short-cuts.”

He explained that the level of imports seen today are nowhere near the level of imports 10 years ago, and if the country continues to import everything including animal-waste the cedi will never stabilise.

“The fiscal misadventure will require the Governor to take certain measures which will be unpalatable. Which government has shown fiscal discipline? They show fiscal discipline, then 18 months to election it is blown. Every government has done that. You won’t go anywhere with that.

“The economy has been over-liberalised, which is one of the woes we face as a country. Too much World Trade Organisations (WTO) rules have been accepted here.

“If there is no dollar, the governor is to blame. Does he control ministry of trade? We have a country that has one minister for trade and industry; there is no relationship between trade and industry.

“The direct competitor of trade is industry. If you promote trade, industry suffers and if you promote industry, trade suffers; but we live in a country where there is only one minister for both; so when that minister goes to cabinet, which one is he or she going to promote?

“He or she will push for trade because that gives quick Gross Domestic Product growth, but it is disadvantageous to the country in the long-term because it worsens the balance of payments, takes away foreign exchange, and does not create the jobs that industry would create.

“The two should be separated and never be friends. The two ministries should be enemies, just like head of credit and head of risk in the banks. Credit wants to do credit and risks want to slow them down because of the risks associated with credit, they are never friends.”

He added that the banks are working hard to get more of the unbanked population into the banking sector but when the minister for finance puts VAT on banking services, how will that work?

“It was not a well thought through policy. They just looked at our results, commissions and fees, and then said we made this much from these sectors so let’s slap 17.5 percent on it. Arithmetic is different from reality. Now people won’t bring business to us again.”

Business News of Monday, 14 July 2014

Source: B&FT