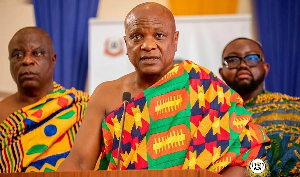

Minister for Finance, Ken Ofori-Atta, expressed his appreciation for the Group of 20 (G20) for its historic decision to include the African Union in its decision-making body.

Mr. Ofori-Atta highlighted the significance of this move, emphasizing that Africa would now have a prominent platform to articulate its narrative, address its challenges, and provide recommendations from an African perspective, thus allowing the continent to play a more active role in global development.

"There had been a number of decisions taken without Africa on the board and thank God the G20 agreed that Africa will have a seat so we will be part of the designing the solutions to our Global challenges" noted the Minister.

These remarks were made during the Rockefeller Foundation event on the Energy Transition Accelerator, held as part of the side meetings at the ongoing United Nations General Assembly.

The Energy Transition Accelerator (ETA) aims to fund the retirement of coal-fired power plants and promote the adoption of clean energy in Emerging Markets and Developing Economies (EMDEs) through the sale of carbon credits until 2030.

The ETA aspires to generate high-quality carbon credits to attract private investment, create jobs, foster socio-economic growth, and address urgent adaptation needs without worsening energy poverty.

The Minister revealed that Ghana had inked Memoranda of Understanding (MOUs) with Switzerland, Sweden, and Singapore, and was actively engaging with South Korea, which had expressed interest in collaboration. He highlighted a significant development with Switzerland, where 5 million carbon credits would be exchanged for $100 million in carbon financing.

He underscored the considerable expense associated with carbon credits for African countries, despite their limited participation in carbon transactions or trade. He emphasized the importance of ongoing partnerships involving philanthropic organizations, the private sector, and other stakeholders to shift the focus from lender's risk to investment.

"Africa faces substantial challenges related to climate change, incurring annual costs ranging from 5 to 15 percent of its per capita GDP. Although the continent possesses abundant opportunities in clean and renewable energy, current climate finance falls far short of the required resources.

Africa needs US$277 billion annually to fulfill its Nationally Determined Contributions by 2030, yet the current annual climate flows amount to just US$30 billion, representing less than 11 percent of the necessary funding," he noted.

Ofori-Atta continued, "Additionally, almost 55 percent of Africa's climate finance comes in the form of debt, with the private sector contributing only 14 percent of total climate finance and a mere 3 percent toward adaptation finance."

"To adequately support Africa's adaptation efforts and expedite its mitigation initiatives, the minister emphasized the urgent need for a substantial increase in financing. Regrettably, Africa currently attracts less than 1 percent of global green bond issuances, despite its immense potential for green investments. Furthermore, the issuance cost for African green bonds exceeds that of similarly rated peers by more than double."

"As we move forward, it is crucial for the international community, including the private sector, to collaborate and ensure that African economies are not excluded from green finance opportunities due to perceived economic risks," he concluded.

The meeting witnessed the presence of notable figures, including Secretary John Forbes Kerry, the U.S. Presidential envoy on climate; Andrew Steer, President and CEO of Bezos Earth Fund; Axel van Trotsenburg, Senior Managing Director at the World Bank; Elizabeth Yee, Executive Vice President of the Rockefeller Foundation, and other distinguished personalities.

Business News of Friday, 22 September 2023

Source: www.ghanaweb.com