Business News of Friday, 3 March 2017

Source: classfmonline.com

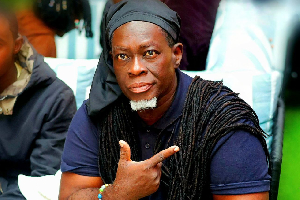

'Kaya tax' nonexistent - Benjamin Kunbuor

The decision by the Akufo-Addo-led government to scrap market tolls imposed on itinerant head porters (Kayayei), as announced by Minister of Finance Ken Ofori-Atta in the government’s first budget statement, is deceptive because such a tax does not exist, Dr Benjamin Kunbuor, former Member of Parliament for Nandom, has said.

The toll is among several taxes lined up by the government to be scrapped completely or reduced so as to bring relief to the ordinary Ghanaian and the business community.

Apart from the Kayayei market toll, excise duty on petroleum products will also be scrapped. The government also intends to reduce the special petroleum tax rate on petrol from 17.5% to 15%.

Other taxes that will be completely abolished include the following:

1. The 1% special import levy

2. The 17.5% VAT on financial services

3. The 17.5% VAT on selected imported medicines not produced locally

4. The 17.5% VAT on domestic airline tickets

5. The 5% VAT on real estate sales

6. Duty on importation of spare parts

Also, the 17.5% VAT imposed on traders has been replaced with a 3% flat rate, while businesses that employ young graduates from tertiary institutions will get tax credits and other incentives.

Furthermore, there will be tax incentives for young entrepreneurs while the Corporate Income Tax will be progressively reduced from 25% to 20% in 2018.

Additionally, Mr Ofori-Atta said the Akufo-Addo government would initiate steps to remove import duties on raw materials and machinery for production.

However, speaking in an interview with Class91.3FM’s Paa Kwesi Parker-Wilson just after the Finance Minister’s presentation, Dr Kunbour said: “I don’t believe we need to start christening children that are not yet born. What we have now are proposals and we will get to the substance of it later. But I want it to be on record that there is no national tax on kayayei for it to be a subject of comment.

“Secondly, let us be very clear in our minds that there is no electrification levy. We used to have an electrification levy that was about 0.004 per cent that has since been scrapped, and, so, if you claim that you are removing the electrification levy, then it doesn’t exist.”