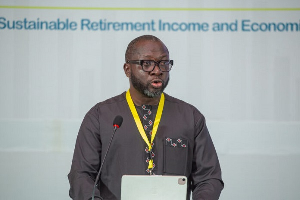

The Chief Executive Officer of the Ghana Association of Banks (GAB), John Awuah, has indicated that interest rates on loans are expected to decline starting August 7, 2025.

This anticipated reduction follows the Bank of Ghana’s recent decision to lower its policy rate by 300 basis points, bringing it down from 28% to 25%.

Speaking in an interview with Joy Business, Awuah addressed public concerns that commercial banks are often slow to respond to cuts in the policy rate.

He explained that the policy rate contributes significantly, about 40%, to the calculation of the Ghana Reference Rate (GRR), which banks use to determine interest rates on loans.

According to him, the recent policy rate change will be reflected in the new GRR, which commercial banks are expected to publish soon.

“So by next Wednesday [August 7, 2025], the commercial banks are expected to publish the new Ghana Reference Rate for August 2025, and we should see quite a good reduction in the Ghana Reference Rate,” he disclosed.

The GAB CEO expressed optimism that once the new reference rate is published, Ghanaians can expect a meaningful reduction in loan interest rates, making borrowing more affordable.

DR/MA

Watch the latest episode of BizTech below:

Business News of Tuesday, 5 August 2025

Source: www.ghanaweb.com