The Institute of Fiscal Studies (IFS) has expressed surprise over the silence of the 2019 mid-year budget on the Exemptions Bill.

Leslie Dwight Mensah, an Economist at the IFS, said in tackling the revenue shortfall, the mid-year budget was silent on when (or whether) the Exemptions Bill that seeks to curtail widespread exemptions in the tax regime would be passed into law.

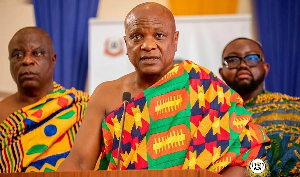

“This is puzzling, especially when the President, in his 2019 State of the Nation address, portrayed a dire picture of the tax exemptions regime, describing it as ‘an Achilles heel in the management of the economy, and a growing threat to fiscal stability and revenue generation,’ which the government was going to deal with”; Mr Mensah said at a press briefing in his presentation of the “IFS’ Assessment of 2019 Mid-Year Fiscal Policy Review” in Accra.

The press briefing was to assess the notable developments in the mid-year review and make recommendations to safeguard fiscal stability, which has come under threat from both revenue and expenditure management difficulties.

He said the Government had estimated that, if the Exemptions Bill was passed, it stands to save GHC500 million of revenue that otherwise would be lost to tax exemptions in 2019.

He said this amount was more than the yield of the tax increases that had been announced; stating that “failure to take action on exemptions is, therefore, costing the nation dearly and prompting the resort to tax hikes to plug revenue shortfalls”.

It would be recalled that on Monday, July 29, Mr. Ken Ofori-Atta, Minister of Finance, presented the mid-year review of the 2019 budget statement and fiscal policy to Parliament.

Notable fiscal policy changes that were announced include energy and communication tax hikes and a request to spend more money (supplementary expenditure estimates) relative to the initial 2019 budget appropriation.

Mr. Mensah said prior to the mid-year budget, the Institute for IFS had reviewed the economy’s performance and provided recommendations to the government to address challenges identified.

He said revenue mobilisation continues to experience missed targets, with a shortfall of 15.5 percent (GHC4.2 billion) recorded in the first half of 2019.

“This is not surprising as the revenue forecasts have always looked over-optimistic, given projected real gross domestic product (GDP) growth and inflation rates, as well as tax revenue giveaways that were not matched by strong offsetting revenue measures.

He said an example was the reduction in benchmark import values in April, which narrowed the import tax base and contributed to a 17.5 percent (GHC1.2 billion) shortfall in customs receipts in the first half of the year.

He said to salvage the fiscal programme that was under threat from weak revenue collection, the government raised the communication service tax (CST), road fund levy, energy debt recovery levy, and price stabilization and recovery levy.

He said together, the hikes were expected to yield less than GHC400 million in additional revenue from the affected tax handles in 2019.

He noted that other revenue measures are the planned sale of electromagnetic spectrum and collection of telecom licence renewal fees to shore up non-tax revenue, which performed poorly in the first half of the year.

“With these measures, as well as the pledge of stronger tax enforcement, the revenue forecast for the whole year has been more or less maintained at GHC58.9 billion,” he said.

Mr. Mensah recommended that revenue targets need to be set realistically, as missed targets disrupt the fiscal programme and undermine effective budget execution.

He said the Ministry of Finance should, therefore, strengthen its revenue forecasting; adding that the impact of proposed revenue policy changes should be robustly appraised and realistically forecasted prior to implementation of the policies.

He urged the government to move quickly to curtail exemptions in the tax regime, many of which are inefficient and costly.

He said to this end, the passage of the Exemptions Bill was critical, and the IFS stands ready to provide inputs for the bill’s refinement before enactment.

Business News of Thursday, 8 August 2019

Source: ghananewsagency.org