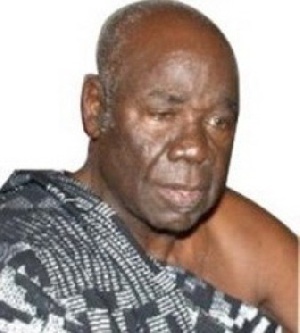

Nana Appiah Menkah, a Ghanaian Industrialists, has asked government to adopt a protectionist approach towards Ghanaian industries to save them from collapse.

He said placing a ban on the importation of foreign goods could go a long way to assist Ghanaian businesses to grow and encourage people to buy the locally made goods.

Nana Menkah said this when he chaired a day's forum on the theme: “The High Cost of Credit: Implications for Ghana and the Way Forward,” in Accra on Tuesday.

It was organised by the Ministry of Trade and Industry and sponsored by the Institute of Economic Affairs, Ghana Free Zones Board, Association of Ghana Industries and Private Enterprise Federation.

Other supporters were WEBB Fontaine, Ghana Standards Authority, First Capital Plus Bank, and Ghana Link Network, among others.

The forum was to find answers to questions on how to lower the lending rate and come out with the roadmap for effective implementation of recommendations.

Nana Menkah appealed to banks to assist industries by lowering the lending rates so that Ghanaian entrepreneurs would be able to produce made-in-Ghana goods at affordable prices.

He noted that the influx of foreign goods into the Ghanaian market at relatively lower prices was a disadvantage to Ghanaian industries.

“It is about time we came together to protect made-in-Ghana goods in order to boost the Ghanaian industries and the economy.”

Dr Charles Godfred Ackah from the Institute of Statistical, Social and Economic Research, University of Ghana, also called for the setting up of a consumer protection authority to serve as a check on the banks, especially on the issue of lending rates.

He wondered how all the banks could have their lending rates at the same high level, noting that a situation where all banks were charging high interest rates meant that they were not in competition.

Dr Ackah, therefore, called for the setting up of development banks to be owned by government to give credit at reasonable cost.

He also urged government to learn from operations of development banks in China and Malaysia.

Business News of Thursday, 7 May 2015

Source: GNA

Govt urged to protect Ghanaian industries

Entertainment